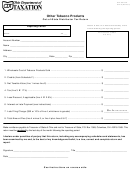

MONTANA

TP-101

page 2

Section 2: If you are a wholesaler, list separately your other tobacco products and moist snuff sold in Montana during the

month. If you are a retailer, list separately your other tobacco products and moist snuff purchased during the month. You

may attach additional pages if necessary, or submit a replica of Section 2.

(A) Invoice Number

(B) Licensed Montana Tobacco Products

(C) Montana

(D) Other

(E) Moist

Retailer, Wholesaler or Manufacturer Name

Retailer’s

Tobacco

Snuff Sold.

Tobacco

Products

Enter Weight

License

Wholesale

in Ounces

Number

Price

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

18. Add the amounts in Columns D and E and enter the results on this line. Enter

the amount from Column D in Section 1, line 8 and the amount from Column E in

Section 1, line 11. ....................................................................................................18. $

oz

Section 3: List separately, your other tobacco products and moist snuff that you returned to the manufacturer or

destroyed during the month where a tax was paid in a prior month. You may attach addition pages if necessary or a

replica of Section 3.

(F) Credit Invoice

(G) Manufacturer Name

(H) Credit

(I) Other

(J) Moist

Number

Invoice Date

Tobacco

Snuff

Products

Wholesale

Price

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

$

oz

19. Add the amounts in Columns I and J and enter the results here ............................19. $

oz

20. Entered for you are the other tobacco products and moist snuff tax rates ..............20.

0.50 (50%)

0.85 ($0.85)

21. Multiply line 19 by the tax rates on line 20 and enter the result here ......................21. $

oz

22. Combine the amounts from line 21, Columns I and J and enter the result here ...............................22. $

23. Multiply the amount on line 22 by 0.015 (1.5%) and enter the result here ........................................23. $

24. Subtract line 23 from line 22 and enter the result here. This is your credit on returned other tobacco

products and moist snuff where tax was reported in a prior period. Enter this amount in Section 1,

line 16................................................................................................................................................24. $

1

1 2

2 3

3 4

4