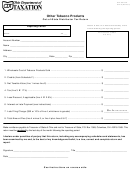

appearance, type, package or labeling,

Column I Enter the total wholesale price of the

tobacco products that were returned for

are suitable for use and are likely to be

offered to or purchased by a consumer as

credit. This wholesale price is the amount

tobacco for making cigarettes.

you used to calculate and pay your tax

originally. Do not include the wholesale

Line 11

Complete Section 2 before entering the

price of moist snuff in this amount.

weight of your moist snuff sales on line 11.

Enter on line 11, the total ounces of moist

Column J Enter, in ounces, the total weight of

snuff reported in Section 2, column E, line

moist snuff that was returned to the

18. See Section 2 instructions above.

manufacturer for credit.

Line 14

You are entitled to a 1.5% discount on

Line 19

Enter the total amounts from columns I

your total other tobacco products and

and J separately on line 19. Your credit is

moist snuff tax. This discount is offered

determined separately for other tobacco

to you to defray your collection and

products and moist snuff.

administrative expenses of this tax.

Line 20

We have entered for you the applicable

Multiply your tax amount reported on line

tax rates.

13 by .015 and enter the result on line 14.

Line 21

Multiply the amount on line 10 by the tax

Line 16

Complete Section 3 before entering your

rate on line 20 and enter the result on line

credit on line 16. Enter on line 16, your

21.

total credit reported in Section 3, line 24.

Line 22

Combine the amounts in columns I and J

Section 3

on line 21 and enter the result on line 22.

Column F Enter the credit invoice number for each

Line 23

Because you were originally allowed a

order of other tobacco products or moist

collection and administrative expense

snuff that you sold to a licensed Montana

allowance, you are required to reduce

wholesaler during this reporting period. If

your credit by the amount of this

you are a retailer completing this form and

allowance. Multiply the amount on line 22

you purchased products directly from the

by .015 and enter the result on line 23.

manufacturer, enter the manufacturer’s

Line 24

Subtract the amount on line 23 from the

invoice number shown on your purchase

amount on line 22 and enter the result

order.

here. This is your credit on returned

Column G Enter the name of each licensed Montana

other tobacco products and moist snuff

tobacco products retailer who you sold

products. Enter this amount in Section 1,

other tobacco products or moist stuff to

line 16.

during this reporting period. If you are

Please sign the return and provide the title and

a retailer completing this form and you

daytime phone number of the person signing this

purchased products directly from the

return.

manufacturer, enter the manufacturer’s

name as shown on your purchase order.

Please call us at (406) 444-6900 if you have any

questions regarding the completion of this return.

Column H Enter the date the manufacturer issued

you a credit for tobacco products returned.

1

1 2

2 3

3 4

4