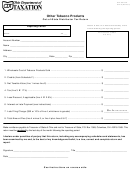

MONTANA

TP-101

Page 3

Other Tobacco Products and Moist Snuff Tax Return Instructions

If you have any questions about completing this return, please call us at (406) 444-6900, or download

detailed instructions for Form TP-101 from our web site at

General Instructions

other tobacco products or moist stuff to

during this reporting period. If you are

Line 1

Enter your federal employer identifi cation

a retailer completing this form and you

number (FEIN) on line 1.

purchased products directly from the

Line 2

Enter your Department of Revenue

manufacturer, enter the manufacturer’s

account identifi cation number.

name as shown on your purchase order.

Line 3

Enter your reporting period and fi ling date.

Column C Enter the Montana retailer’s tobacco

license number for each sale of other

Line 4

If you are amending a prior-period return,

tobacco products or moist snuff you sold

check the box on line 4.

during this reporting period.

Line 5

If you are no longer in business, and are

Column D Enter the total wholesale price of other

fi ling a fi nal return, check the box on line

tobacco products sold to each Montana

5 and enter the date that your business

retailer during this reporting period. Do not

ceased operations.

include the wholesale price of moist snuff

Line 6

If your address has changed from the

in this amount.

last report fi led, check the box on line 6

Wholesale price is defi ned as the

and print your new address in the space

established price for which a manufacturer

provided.

sells a tobacco product to a wholesaler

Line 7

Enter your current tobacco products

or any other person before any discount

license number.

or other reduction. Do not use the price

that you, as a wholesaler, sell other

Tax Computation Instructions (See page 1 for details

tobacco products to a retailer. If you are

about the mathematical calculation lines on this

a retailer completing this form and you

return.)

purchased products directly from the

Section 1 (

Complete Section 2 before entering your

manufacturer, enter the wholesale price

total wholesale price on line 8.)

the manufacturer charges you before any

discounts or other reductions.

Line 8

Enter on line 8 the total amount reported

in Section 2, column D, line 18. See

Column E Enter in ounces, the total moist snuff

section 2 instructions below.

sold to each Montana retailer during

this reporting period. If you are a retailer

(Instructions for lines 9 through 16 continue

completing this form and you purchased

after Section 2, Column E, instructions.)

moist snuff directly from the manufacturer,

enter, in ounces, the total moist snuff

Section 2

purchased during this reporting period.

Column A Enter the invoice number for each order

Moist snuff is defi ned as any fi nely cut,

of other tobacco products or moist snuff

ground or powdered tobacco, other than

that you sold to a licensed Montana

dry snuff, that is intended to be placed in

wholesaler during this reporting period. If

the oral cavity.

you are a retailer completing this form and

you purchased products directly from the

(Section 1 continued, lines 9 through 16)

manufacturer, enter the manufacturer’s

Line 9

Enter, in ounces, the total weight of

invoice number shown on your purchase

“roll-your-own” tobacco products that are

order.

included in the wholesale price on line

Column B Enter the name of each licensed Montana

8. “Roll-your-own” tobacco products are

tobacco products retailer who you sold

tobacco products that, because of their

1

1 2

2 3

3 4

4