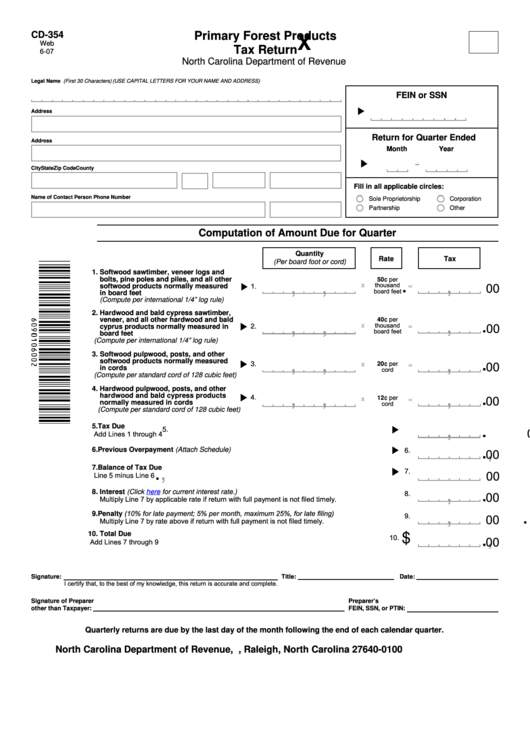

CD-354

Primary Forest Products

X

Web

Tax Return

6-07

North Carolina Department of Revenue

Legal Name (First 30 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

FEIN or SSN

Address

Return for Quarter Ended

Address

Month

Year

-

City

State

Zip Code

County

Fill in all applicable circles:

Name of Contact Person

Phone Number

Sole Proprietorship

Corporation

Partnership

Other

Computation of Amount Due for Quarter

Quantity

Rate

Tax

(Per board foot or cord)

1. Softwood sawtimber, veneer logs and

bolts, pine poles and piles, and all other

50¢ per

.

,

,

,

00

thousand

1.

x

softwood products normally measured

=

board feet

in board feet

(Compute per international 1/4” log rule)

2. Hardwood and bald cypress sawtimber,

veneer, and all other hardwood and bald

40¢ per

.

,

,

,

00

thousand

x

2.

=

cyprus products normally measured in

board feet

board feet

(Compute per international 1/4” log rule)

3. Softwood pulpwood, posts, and other

.

,

,

,

softwood products normally measured

00

3.

x

20¢ per

=

in cords

cord

(Compute per standard cord of 128 cubic feet)

4. Hardwood pulpwood, posts, and other

.

,

,

,

hardwood and bald cypress products

4.

00

12¢ per

x

=

normally measured in cords

cord

(Compute per standard cord of 128 cubic feet)

,

.

5. Tax Due

00

5.

Add Lines 1 through 4

,

.

6. Previous Overpayment (Attach Schedule)

00

6.

7. Balance of Tax Due

,

.

00

7.

Line 5 minus Line 6

,

.

8. Interest (Click

here

for current interest rate.)

00

8.

Multiply Line 7 by applicable rate if return with full payment is not filed timely.

9. Penalty (10% for late payment; 5% per month, maximum 25%, for late filing)

,

.

9.

00

Multiply Line 7 by rate above if return with full payment is not filed timely.

10. Total Due

,

.

$

10.

00

Add Lines 7 through 9

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Signature of Preparer

Preparer’s

other than Taxpayer:

FEIN, SSN, or PTIN:

Quarterly returns are due by the last day of the month following the end of each calendar quarter.

North Carolina Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0100

1

1 2

2