Page 4

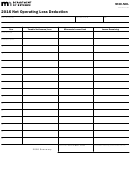

500-NOL

(Rev. 7/13)

General Instructions

Election: A taxpayer is bound by the Federal election to forego the carry-

back period. A copy of this election should be attached to the Georgia

A net operating loss carry-back adjustment may be filed on this fom by an

return. If there is a Georgia N.O.L. but no Federal N.O.L., the taxpayer may

individual or fiduciary taxpayer that desires a refund of taxes afforded by

make an election “for Georgia purposes only” under the same rules and

carry-back of a net operating loss. This form must be filed no later than 3

restrictions as the Federal election.

years from the due date of the loss year income tax return, including any

extensions which have been granted. Form 500X should not be used to

Example: A taxpayer has a large Net Operating Loss in 1998 (both Federal

carry-back a N.O.L.

and Georgia). With his timely filed Federal return, he includes a statement

that he elects to forgo the carry-back period. He must therefore carry his

Georgia (as well as his Federal) N.O.L. forward without first carrying it

Generally a net operating loss must be carried back and forward in the

procedural sequence of taxable periods provided by Section 172 of the

back. Any portion not absorbed after 20 years is lost.

Internal Revenue Code of 1986, as it existed on January 3, 2013. Gener-

Page 1 Instructions

ally the carry-back period is 2 years (with special rules for farmers (5

years), casualty losses (3 years); specified liability loss (10 years), small

Columns a, c, and e.

business loss attributable to federally declared disasters (3 years); etc).

Enter the amounts from your original return or as previously adjusted by

However, Georgia does not follow the following federal provisions:

you or the Department of Revenue.

Columns b, d, and f.

• Special carry-back rules enacted in 2009.

• Special rules relating to Gulf Opportunity Zone public utility casualty

Lines 1 and 5, enter the amounts after adjustments that are required by

losses, I.R.C. Section 1400N(j).

I.R.C. Section 172, if any.

• 5 year carry-back of NOLs attributable to Gulf Opportunity Zone losses,

I.R.C. Section 1400N(k).

Lines 2 and 7, enter the amounts from your original return or as previously

• 5 year carry-back of NOLs incurred in the Kansas disaster area after May

3, 2007, I.R.C. Section 1400N(k).

adjusted by you or the Department of Revenue.

• 5 year carryback of certain disaster losses, I.R.C. Sections 172(b)(1)(J)

Line 10, the credit for taxes paid to other states should be recomputed

and 172(j).

based on the new Georgia AGI and deductions. Other credits that are

• The election to deduct public utility property losses attributable to May 4,

based on liability should be adjusted accordingly. Any credits that are not

2007 Kansas storms and tornadoes in the fifth tax year before the year

of the loss, I.R.C. Section 1400N(o).

allowed and that are eligible for carry-forward can be carried forward.

Within 90 days from the last day of the month in which this form is filed, the

Page 2 Instructions

Commissioner of Revenue shall make a limited examination of the form

A Georgia Net Operating Loss (N.O.L.) must be computed separately

and disallow without further action any form containing errors of computa-

from any Federal N.O.L. It is possible to have a Federal N.O.L., but

tion not correctable within such 90-day period or having material omissions.

not a Georgia N.O.L.

A decrease of tax determined for prior year tax will first be credited against

any unpaid tax and any remaining balance will be refunded to the taxpayer

Line 21. In computing a Georgia N.O.L., only Georgia amounts can be

without interest within the 90-day period.

used. Interest on U.S. savings bonds should be entered as a negative

number on this line. Non Georgia municipal interest should be entered as

*Note: This form shall constitute a claim for credit or refund.

a positive number on this line. The nonbusiness portion of the retirement

exclusion should be entered as a negative number on this line. This should

If the commissioner should determinie that the amount credited or refunded

be computed as follows. The total nonbusiness income (as it is defined

by an application is in excess of the amount properly attributable to the

for NOL purposes) that is included in the retirement exclusion should be

carry-back with respect to which such amount was credited or refunded, the

divided by the total income that is included in the retirement exclusion.

commissioner may assess the amount of the excess as a deficiency as if it

This percentage should then be multiplied by the retirement exclusion.

were due to a mathematical error appearing on the face of the return.

For example, if the taxpayer has $8,000 in wages and $20,000 in interest

income, the taxpayer would divide $20,000 by $28,000 and then multiply

What to attach:

this by the retirement exclusion amount.

1. Copy of Federal Application for Net Operating Loss.

When computing the percentage the following guidelines should be

followed:

2. Copy of Federal return for the loss year that includes pages 1 and 2,

schedules A, D, and E.

1. If the total nonbusiness income that is included in the retirement

exclusion is zero or less than zero, the percentage is zero. This would

3. Copy of Federal returns for the carry-back years that includes pages 1

apply even if the total income that is included in the retirement exclusion is

and 2, schedule A and any schedules that were recalculated in carry-back

zero or less than zero.

year.

2. If the total nonbusiness income that is included in the retirement

4. Copy of Georgia returns for the carry-back or carry-forward years

exclusion is greater than zero and exceeds the total income that is included

in the retirement exclusion, the percentage is 100%. This would apply

5. Copy of Georgia form 500 for the loss year.

even if the total income that is included in the retirement exclusion is zero

or less than zero.

Be sure to attach all required forms listed above and complete all lines of

the Form 500-NOL that apply. Otherwise your application may be disallo-

Additionally, in situations where two people file married filing joint, a

wed.

separate computation should be made to determine each taxpayer’s portion

of the retirement exclusion that is related to nonbusiness income.

The carryback period may be foregone and the N.O.L. carried forward.

Page 3 Instructions

Net Operating Loss Carryover. See instructions on page 3.

Part Year and Nonresident Instructions. See instructions on page 3.

1

1 2

2 3

3 4

4