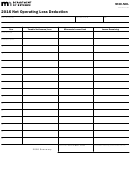

Page 2

500-NOL

(Rev. 7/13)

COMPUTATION OF NET

OPERATING LOSS - LOSS YEAR

PART YEAR AND NONRESIDENTS, SEE INSTRUCTIONS ON PAGE 3

1.

1.

Adjusted gross income, Line 8, Page 2 of form 500

2.

2.

Line 9 adjustments. ..........................................................................................................................................

3.

Deductions (Applies to individuals only). ..........................................................................................................

3a.

a. Enter amount of your Standard or Itemized Deductions, Line 11c or Line 12 of form 500. ........................

3b.

b. Personal exemption, Line 14c of form 500. ................................................................................................

4.

4.

Total (Lines 3a and 3b) .....................................................................................................................................

5.

5.

Taxable income. Total of Line 1 and Line 2 less Line 4 ...................................................................................

6.

6.

Exemptions claimed, Line 14c of form 500 ......................................................................................................

7.

7.

Nonbusiness capital losses before limitation. Enter as a positive number ..............

8.

8.

Total nonbusiness capital gains(without regard to any I.R.C section 1202 exclusion)

9.

9.

If Line 7 is more than Line 8, enter the difference; otherwise, enter -0- ..................

10. If Line 8 is more than Line 7, enter the difference; otherwise, enter -0- ..................

10.

11. Enter either your standard deduction or itemized

deductions less casualty, 2106 deductions, and

11.

state and local income taxes .....................................

12.

12. Contributions to self-employed pension plan or Keogh

13.

13. Alimony (paid) ............................................................

14.

14. Forfeited interest/penalty on early withdrawal ...........

15.

15. Contribution to an IRA ...............................................

16.

16. Other (specify) ...........................................................

17.

17. Total nonbusiness deductions (Lines 11 through 16)

18.

18. Dividend income ........................................................

19.

19. Interest income ..........................................................

20.

20. Alimony/pensions/annuities .......................................

21. GA adjustment for retirement exclusion, U.S. interest,

non-Georgia municipal interest, etc. See instructions on

21.

Page 4 .......................................................................

22.

22. Other (specify) ...........................................................

23.

23. Total nonbusiness income other than capital gains (Lines 18 through 22) ............

24.

24. Add Lines 10 and 23 ...............................................................................................

25. If Line 17 is more than Line 24, enter the difference; otherwise enter -0- ...............

25.

26. If Line 24 is more than Line 17, enter the difference; otherwise enter -0-.

26.

Do not enter more than Line 10 ..............................................................................

27.

27. Total business capital losses before limitation. Enter as a positive number ............

28.

28. Total business capital gains (without regard to I.R.C. section 1202 exclusion) .......

29.

29. Add Lines 26 and 28 ...............................................................................................

30.

30. If Line 27 is more than Line 29, enter the difference; otherwise enter -0- ...............

31.

31. Add Lines 9 and 30. ................................................................................................

32. Enter your net capital loss before the $3,000 federal limitation, if any. Enter as a

positive number. If you do not have this loss (and do not have an I.R.C. section

1202 exclusion) skip Lines 32 through 37 and enter on Line 38 the amount from

32.

Line 31 .....................................................................................................................

33. I.R.C. section 1202 exclusion (50% exclusion for gain from certain small business

33.

stock). Enter as a positive number. ........................................................................

34.

34. Subtract Line 33 from Line 32. If zero or less enter -0- ..........................................

35. Enter your net capital loss after the $3,000 Federal limitation.

35.

Enter as a positive number ......................................................................................

36.

36. If Line 34 is more than Line 35, enter the difference; otherwise enter -0- ...............

37.

37. If Line 35 is more than Line 34, enter the difference; otherwise enter -0- ........................................................

38.

38. Subtract Line 36 from Line 31. If zero or less, enter -0- ..................................................................................

39.

39. Previous net operating loss claimed. Enter as a positive number ...................................................................

40.

40. Add Lines 6, 25, 33, 37, 38, 39 ......................................................................................................................................................................

41. Net operating loss. Combine Lines 5 and 40. If the result is less than zero, enter it here and on Page 1. If the loss is being carried to a part

41.

year or nonresident return, see instructions on Page 3. If the result is zero or more, you do not have a net operating loss. ......................

1

1 2

2 3

3 4

4