Page 3

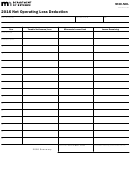

500-NOL

(Rev. 7/13)

NET OPERATING LOSS CARRYOVER

Complete if applicable

____________preceding tax year

___________preceding tax year

___________preceding tax year

Complete one column before going to the next

column. Start with the earliest carryback year.

ended_____________________

ended_____________________ ended_____________________

1. Net operating loss deduction

2. Taxable income before N.O.L. carryback

3. Net capital loss deduction. Enter as a

positive number ......................................

4. I.R.C section 1202 exclusion. Enter as a

positive number ......................................

5. Adjustments to adjusted gross income ..

6. Adjustments to itemized deductions ......

7. Exemptions .............................................

8. Modified taxable income. Combine Lines

2 through 7. If zero or less, enter -0- .....

9. Net operating loss carryover. Line 1 less

Line 8. If zero or less, enter -0- .............

Net Operating Loss Carryover Instructions

1. General: A Georgia Net Operating Loss (N.O.L.) carryover must be computed separately from any Federal N.O.L. carryover.

It is possible to have a Federal N.O.L. carryover but not a Georgia N.O.L. carryover.

2. Line 3, enter as a positive number the adjustment as required by I.R.C. Section 172, if it applies.

3. Line 4, enter as a positive number the gain excluded under I.R.C. section 1202 on the sale or exchange of qualified small business

stock, if it applies.

4. Lines 5 and 6, enter the adjustments that are required by I.R.C. Section 172, if any.

PART YEAR AND NONRESIDENTS

Complete if applicable

Column A

Column B

Column C

Total

Non Georgia

Georgia

Year_________ Use a separate schedule for all applicable years.

1. Georgia Adjusted Gross Income. See instructions below.

2. N.O.L., enter Georgia portion in Georgia column. In total

column only enter the Federal N.O.L. incurred while

subject to Georgia taxation. See instructions below.

3. Adjusted AGI for N.O.L. purposes.

4. Percentage. Line 3, column C divided by column A.

See instructions below.

5. Itemized or standard deduction. See instructions below.

6. Personal exemptions.

7. Total deductions and exemptions; add Lines 5 & 6.

8. Line 4 percentage times Line 7.

9. Adjusted taxable income, column C, Line 3 less Line 8,

enter here and on taxable income Line of Page 1.

Part Year and Nonresident schedule instructions. (Use if carrying the loss to a part year or nonresident return.)

1. Lines 1 and 5, enter the amounts, after the adjustments that are required by I.R.C. Section 172 if any apply, for the year

the loss is being carried to.

2. Line 2 column C, enter loss from Page 2, Line 41 or from Page 3, Line 9 of the net operating loss carryover schedule.

3. Line 4, if Georgia AGI is zero or negative, the percentage is zero. If the adjusted Federal AGI is zero or negative, the Line 4

percentage is considered to be 100%. This also applies if both adjusted Federal AGI and Georgia AGI are zero or negative. In

this case, the taxpayer is entitled to the full exemption amount and deductions.

Additional instructions for part year and nonresidents.

1. 500-NOL Page 1. Lines 1 through 7 should not be completed for any years for which a part year or nonresident return was filed.

Instead the part year and nonresident schedule above should be completed.

2. 500-NOL Page 2. If the loss year is a part year or nonresident year for Lines 3a, 3b, 6, and 11, compute the amount and then multiply

it by the percentage of Georgia AGI to adjusted Federal AGI on schedule 3 of the loss year return. For example, if you have one

exemption, multiply $2,700 by the percentage on schedule 3 of the loss year return. The other Lines on Page 2 that pertain to

Georgia source income should also be filled in.

3. 500-NOL Page 3. net operating loss carryover schedule. If any years on this schedule are part year or nonresident years, for Lines 6

and 7, compute the amount and then multiply it by the percentage on Line 4 of the part year and nonresident schedule. For

example, if you have one exemption, multiply $2,700 by the percentage on Line 4 of the above schedule.

The other Lines on the net operating loss carryover schedule that pertain to Georgia source income should also be filled in.

1

1 2

2 3

3 4

4