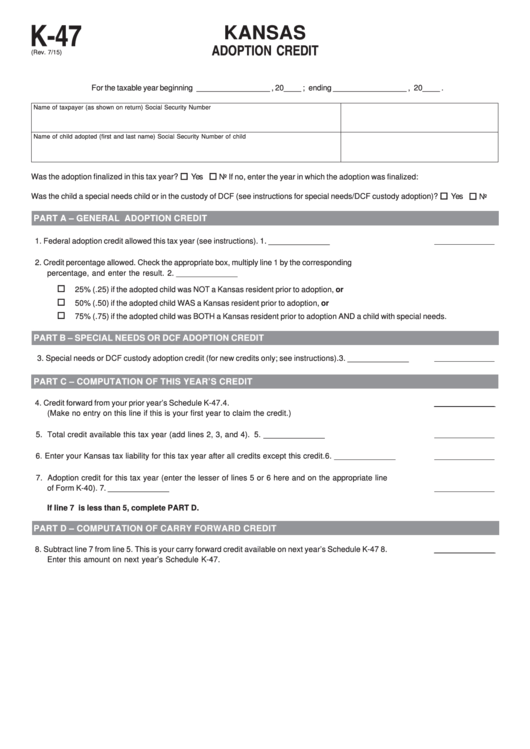

K-47

KANSAS

ADOPTION CREDIT

(Rev. 7/15)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number

Name of child adopted (first and last name)

Social Security Number of child

Yes

Was the adoption finalized in this tax year?

No If no, enter the year in which the adoption was finalized:

Yes

Was the child a special needs child or in the custody of DCF (see instructions for special needs/DCF custody adoption)?

No

PART A – GENERAL ADOPTION CREDIT

1. Federal adoption credit allowed this tax year (see instructions).

1.

______________

2. Credit percentage allowed. Check the appropriate box, multiply line 1 by the corresponding

percentage, and enter the result.

2.

______________

25% (.25) if the adopted child was NOT a Kansas resident prior to adoption, or

50% (.50) if the adopted child WAS a Kansas resident prior to adoption, or

75% (.75) if the adopted child was BOTH a Kansas resident prior to adoption AND a child with special needs.

PART B – SPECIAL NEEDS OR DCF ADOPTION CREDIT

3. Special needs or DCF custody adoption credit (for new credits only; see instructions).

3.

______________

PART C – COMPUTATION OF THIS YEAR’S CREDIT

4. Credit forward from your prior year’s Schedule K-47.

4.

______________

(Make no entry on this line if this is your first year to claim the credit.)

5. Total credit available this tax year (add lines 2, 3, and 4).

5.

______________

6. Enter your Kansas tax liability for this tax year after all credits except this credit.

6.

______________

7. Adoption credit for this tax year (enter the lesser of lines 5 or 6 here and on the appropriate line

of Form K-40).

7.

______________

If line 7 is less than 5, complete PART D.

PART D – COMPUTATION OF CARRY FORWARD CREDIT

8. Subtract line 7 from line 5. This is your carry forward credit available on next year’s Schedule K-47

8.

______________

Enter this amount on next year’s Schedule K-47.

1

1 2

2