K-36

KANSAS

TELECOMMUNICATIONS CREDIT

(Rev. 9/13)

For the taxable year beginning, _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Employer ID Number (EIN)

Name of parent corporation

Employer ID Number (EIN)

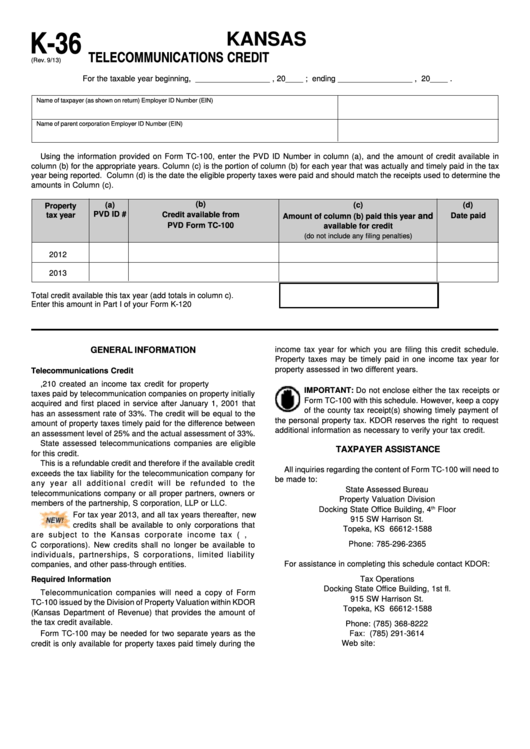

Using the information provided on Form TC-100, enter the PVD ID Number in column (a), and the amount of credit available in

column (b) for the appropriate years. Column (c) is the portion of column (b) for each year that was actually and timely paid in the tax

year being reported. Column (d) is the date the eligible property taxes were paid and should match the receipts used to determine the

amounts in Column (c).

(b)

(a)

(c)

(d)

Property

PVD ID #

Credit available from

tax year

and

Date paid

Amount of column (b) paid this year

PVD Form TC-100

available for credit

(do not include any filing penalties)

2012

2013

Total credit available this tax year (add totals in column c).

Enter this amount in Part I of your Form K-120 ....................................

GENERAL INFORMATION

income tax year for which you are filing this credit schedule.

Property taxes may be timely paid in one income tax year for

property assessed in two different years.

Telecommunications Credit

K.S.A. 79-32,210 created an income tax credit for property

IMPORTANT: Do not enclose either the tax receipts or

taxes paid by telecommunication companies on property initially

Form TC-100 with this schedule. However, keep a copy

acquired and first placed in service after January 1, 2001 that

of the county tax receipt(s) showing timely payment of

has an assessment rate of 33%. The credit will be equal to the

the personal property tax. KDOR reserves the right to request

amount of property taxes timely paid for the difference between

additional information as necessary to verify your tax credit.

an assessment level of 25% and the actual assessment of 33%.

State assessed telecommunications companies are eligible

TAXPAYER ASSISTANCE

for this credit.

This is a refundable credit and therefore if the available credit

All inquiries regarding the content of Form TC-100 will need to

exceeds the tax liability for the telecommunication company for

be made to:

any year all additional credit will be refunded to the

State Assessed Bureau

telecommunications company or all proper partners, owners or

Property Valuation Division

members of the partnership, S corporation, LLP or LLC.

th

Docking State Office Building, 4

Floor

For tax year 2013, and all tax years thereafter, new

915 SW Harrison St.

credits shall be available to only corporations that

Topeka, KS 66612-1588

are subject to the Kansas corporate income tax (i.e.,

Phone: 785-296-2365

C corporations). New credits shall no longer be available to

individuals, partnerships, S corporations, limited liability

For assistance in completing this schedule contact KDOR:

companies, and other pass-through entities.

Tax Operations

Required Information

Docking State Office Building, 1st fl.

Telecommunication companies will need a copy of Form

915 SW Harrison St.

TC-100 issued by the Division of Property Valuation within KDOR

Topeka, KS 66612-1588

(Kansas Department of Revenue) that provides the amount of

the tax credit available.

Phone: (785) 368-8222

Form TC-100 may be needed for two separate years as the

Fax: (785) 291-3614

credit is only available for property taxes paid timely during the

Web site:

1

1