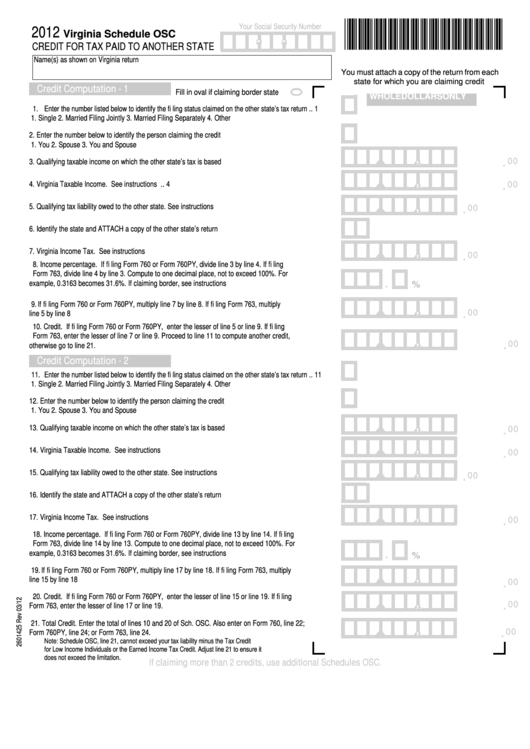

Your Social Security Number

2012

Virginia Schedule OSC

-

-

CREDIT FOR TAX PAID TO ANOTHER STATE

Name(s) as shown on Virginia return

You must attach a copy of the return from each

state for which you are claiming credit

Credit Computation - 1

Fill in oval if claiming border state

WHOLE DOLLARS ONLY

1. Enter the number listed below to identify the fi ling status claimed on the other state’s tax return .. 1

1. Single 2. Married Filing Jointly 3. Married Filing Separately

4. Other

2. Enter the number below to identify the person claiming the credit ............................................. 2

1. You

2. Spouse

3. You and Spouse

,

,

.

3. Qualifying taxable income on which the other state’s tax is based ............................................. 3

00

,

,

.

4. Virginia Taxable Income. See instructions ................................................................................. 4

00

,

,

5. Qualifying tax liability owed to the other state. See instructions ................................................. 5

.

00

6. Identify the state and ATTACH a copy of the other state’s return ............................................... 6

,

,

7. Virginia Income Tax. See instructions ........................................................................................ 7

.

00

8. Income percentage. If fi ling Form 760 or Form 760PY, divide line 3 by line 4. If fi ling

Form 763, divide line 4 by line 3. Compute to one decimal place, not to exceed 100%. For

.

%

example, 0.3163 becomes 31.6%. If claiming border, see instructions ..................................... 8

,

9. If fi ling Form 760 or Form 760PY, multiply line 7 by line 8. If fi ling Form 763, multiply

,

,

.

line 5 by line 8 ............................................................................................................................. 9

00

10. Credit. If fi ling Form 760 or Form 760PY, enter the lesser of line 5 or line 9. If fi ling

Form 763, enter the lesser of line 7 or line 9. Proceed to line 11 to compute another credit,

,

,

.

otherwise go to line 21. ............................................................................................................... 10

00

Credit Computation - 2

11. Enter the number listed below to identify the fi ling status claimed on the other state’s tax return .. 11

1. Single 2. Married Filing Jointly 3. Married Filing Separately

4. Other

12. Enter the number below to identify the person claiming the credit ............................................. 12

1. You

2. Spouse

3. You and Spouse

,

,

13. Qualifying taxable income on which the other state’s tax is based ............................................. 13

.

00

,

,

14. Virginia Taxable Income. See instructions ................................................................................. 14

.

00

,

,

15. Qualifying tax liability owed to the other state. See instructions ................................................. 15

.

00

16. Identify the state and ATTACH a copy of the other state’s return ............................................... 16

,

,

17. Virginia Income Tax. See instructions ........................................................................................ 17

.

00

18. Income percentage. If fi ling Form 760 or Form 760PY, divide line 13 by line 14. If fi ling

Form 763, divide line 14 by line 13. Compute to one decimal place, not to exceed 100%. For

.

example, 0.3163 becomes 31.6%. If claiming border, see instructions ..................................... 18

%

,

19. If fi ling Form 760 or Form 760PY, multiply line 17 by line 18. If fi ling Form 763, multiply

,

,

line 15 by line 18 ......................................................................................................................... 19

.

00

20. Credit. If fi ling Form 760 or Form 760PY, enter the lesser of line 15 or line 19. If fi ling

,

,

.

00

Form 763, enter the lesser of line 17 or line 19. ........................................................................ 20

21. Total Credit. Enter the total of lines 10 and 20 of Sch. OSC. Also enter on Form 760, line 22;

,

,

.

Form 760PY, line 24; or Form 763, line 24. ................................................................................ 21

00

Note: Schedule OSC, line 21, cannot exceed your tax liability minus the Tax Credit

for Low Income Individuals or the Earned Income Tax Credit. Adjust line 21 to ensure it

does not exceed the limitation.

If claiming more than 2 credits, use additional Schedules OSC.

1

1