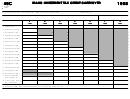

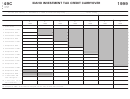

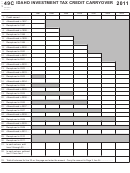

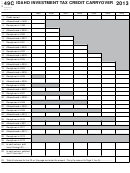

Form 49c - Idaho Investment Tax Credit Carryover - 2014 Page 2

Download a blank fillable Form 49c - Idaho Investment Tax Credit Carryover - 2014 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 49c - Idaho Investment Tax Credit Carryover - 2014 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

ADVERTISEMENT

1

1 2

2 3

3