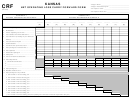

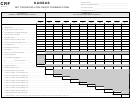

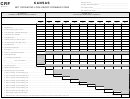

SCHEDULE III

KANSAS ALLOCATION SCHEDULE

Complete this schedule only if any one of the years involved was filed with a different filing status than any other year. You must complete this

schedule for EACH YEAR that an allocation is necessary (see instructions).

(L)

(M)

(N)

Taxpayer SSN:

Spouse SSN:

_ _ _ - _ _ - _ _ _ _

_ _ _ - _ _ - _ _ _ _

Year: _________

Joint Income:

Taxpayer Income:

Spouse Income:

17. Wages, salaries, tips, etc. .............................................................................

18. Interest ...........................................................................................................

19. Dividends less exclusion ...............................................................................

20. Business income ...........................................................................................

21. Taxable capital gains and losses ...................................................................

22. Rents, royalties and partnerships .................................................................

23. Farm income ..................................................................................................

24. Other income .................................................................................................

25. Other adjustments: ___________________________________________

26.

___________________________________________

27. Federal adjusted gross income (Add lines 17 through 26) ...........................

28. Modifications from Part A, Schedule S ..........................................................

29. Additions:

________________________________________________

30.

________________________________________________

31. Subtractions: ________________________________________________

32.

________________________________________________

33. Net Modifications (Add lines 29 and 30, then subtract lines 31 and 32) .......

34. Kansas adjusted gross income .....................................................................

35. Less standard or itemized deductions ..........................................................

36. Less exemptions ...........................................................................................

37. Taxable income (Line 34 minus lines 35 and 36) ...........................................

1

1 2

2 3

3 4

4