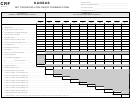

be either a positive or negative amount, while lines 8

to be carried to Schedule I of Form CRF to calculate the

through 13 are usually positive amounts.

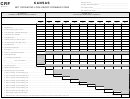

loss. However, if only one spouse sustained the loss, while

the other spouse had income, use the information in

Line 16: This is the unused portion of the net operating

Column L to calculate the loss on Schedule I.

loss. Column B – If the loss exceeds modified taxable

When Schedule III is used for the year to which a loss

income, show the difference on line 16b. Column C

is carried, the information shown in Column M will be used

– If the loss exceeds modified taxable income, show

to complete Schedule II of Form CRF to determine the

the difference on line 16c. Column D – If the loss

income absorbed and the amount of remaining loss. The

exceeds modified taxable income, show the

Kansas loss to be claimed on Schedule S, Part A, Line

difference on line 16d.

A12, cannot exceed the net income for the spouse who

Continue these line instructions for each column until

sustained the loss since the loss of one spouse cannot

the net operating loss is completely used or until it is

be applied to the income of the other spouse.

carried forward 10 taxable years, whichever occurs first.

To avoid a delay in processing or denial of the loss,

enclose the following with your Kansas Individual Income

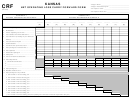

SCHEDULE III – KANSAS ALLOCATION SCHEDULE

Tax Return, Form K-40.

This schedule is used when there is a change in marital

• The completed CRF form. (You must submit a

status between the year of the loss and any of the years

separate CRF for each loss year the net

to which the loss is to be carried. The net operating loss

operating loss carry forward is applied.)

of one spouse cannot be applied to the income of the

• A copy of Federal Form 1045, Application for

other spouse; therefore, it is necessary to determine what

Tentative Refund.

portion of the jointly filed return applies to the spouse

who sustained the loss.

• A copy of Federal Schedule A, Itemized

Deductions and Interest and Dividend Income.

Column L – Joint Income

Lines 17 through 37: Enter the information requested

TAXPAYER ASSISTANCE

which is obtained from the joint federal and Kansas

income tax returns.

For assistance in completing Form CRF, contact

taxpayer assistance:

Column M – Taxpayer SSN and Income

Lines 17 through 37: Enter the Social Security Number

Kansas Department of Revenue

and the income, adjustments and deductions for the

Docking State Office Building, 1

st

Floor

taxpayer who is claiming the loss carry forward.

915 SW Harrison St.

Topeka, KS 66625-2007

Column N – Spouse SSN and Income

Lines 17 through 37: Enter the Social Security Number

Phone: (785) 368-8222

and the income, adjustments and deductions for the

Fax: (785) 291-3614

spouse.

If Schedule III is used for the loss year and both spouses

Additional copies of this credit schedule and other tax

sustained a loss, the information in Column M will need

forms are available from our web site at:

1

1 2

2 3

3 4

4