INSTRUCTIONS FOR FORM CRF

GENERAL INFORMATION

Line 9: Enter the same capital loss that was computed

on your federal net operating loss claim as a positive

To qualify for a Kansas net operating loss carry

figure.

forward, a taxpayer must have all of the following: 1) a

Line 10: Enter the portion of the federal long term capital

federal net operating loss; 2) a Kansas Individual Income

gains excluded from income.

Tax Return, Form K-40, and supporting schedules on file

for the loss year; and, 3) income or loss from Kansas

Line 11: Enter the personal exemption claimed on the

sources or was a Kansas resident during the loss year.

Kansas return.

Kansas statutes require net operating losses

Line 12: Enclose a schedule showing the computation

which are incurred after December 31, 1987, be

of the nonbusiness deductions in excess of

carried forward until fully used or until ten (10)

nonbusiness income for Kansas and enter the result

years has elapsed, whichever occurs first. A Kansas

on line 12. The method of computing the

net operating loss which is incurred after December 31,

nonbusiness deductions in excess of nonbusiness

1987 is not carried back prior to carrying the loss forward.

income is the same as that used for federal purposes.

For loss years prior to 1988, the loss carryover is limited

However, the total amount may differ because income

to seven (7) years.

(from Schedule S, Part A) and Kansas itemized

NONRESIDENTS: A nonresident must determine his net

deductions must be taken into consideration for the

operating loss as though he were a Kansas resident.

Kansas computation.

The loss is determined from information on Form K-40

Line 13: Do not make an entry on lines 13a, 13b and

and is applied to income in the same manner as a resident

13c in the loss year column.

of Kansas would claim the loss carry forward. The

Line 14: Reduce the loss shown on line 7 by the total of

information shown on the Kansas nonresident allocation

lines 8 through 12. If the result is a negative figure,

percentage schedule is not used to determine a Kansas

this will be your Kansas net operating loss. Carry the

net operating loss. Kansas source loss is not applied to

net operating loss from line 14 to the next succeeding

Kansas source income when determining a Kansas

tax year, Schedule S, Part A.

nonresident net operating loss.

If there was a change in marital status (divorce,

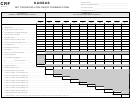

SCHEDULE II – KANSAS DISTRIBUTION SCHEDULE

marriage, or death of one of the spouses) between the

Schedule II is used to determine the amount of loss

year of the loss and any of the years to which the loss is

that is absorbed and the remainder of the loss to be

carried, see the instructions for Schedule III.

carried to the next succeeding year. The computations

There are three basic steps involved in a net operating

for Schedule II are essentially the same as those for

loss carry forward:

Schedule I with a few exceptions.

STEP 1: Complete Schedule I to compute the amount

COLUMNS (B) through (K) – Carry Forward Years

of the loss.

Lines 1 through 11: Enter the requested information

STEP 2: Carry the loss to the next succeeding tax year

from Form K-40, for the applicable year. For line 8,

(Schedule S, Part A)

the Kansas net operating loss included in line 3 will

STEP 3: Complete Schedule II to determine if there is

need to be added.

any remaining loss to be carried to the next carried to

Line 12: The excess nonbusiness deductions are not

the next succeeding year.

added back. Line 12 is left blank for all years except

STEP 4: Complete a separate CRF for each loss year.

the loss year.

LINE BY LINE INSTRUCTIONS

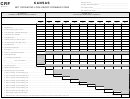

Line 13a: If the allowable portion of the charitable

contributions shown on the federal itemized

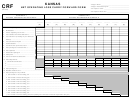

SCHEDULE I – KANSAS COMPUTATION SCHEDULE

deductions have increased, show the same

adjustment as shown on the federal net operating

COLUMN (A) – Loss Year

loss claim on line 13a.

Lines 1 through 6: The information to be entered on

Line 13b: Enter the loss year that is being utilized (in

these lines is taken from the front of the completed

case of multiple loss years), then enter amounts from

Kansas Income Tax Return, Form K-40.

that loss year.

Line 7: Enter the Kansas taxable income from the loss

Line 13c: If you are utilizing more than one loss year,

year. This amount will be a negative figure.

enter the year(s) and amounts from the additional

Line 8: If you have any prior year net operating loss

loss year(s).

included in the adjusted gross income, enter this

Line 14: Enter an amount for the loss year only.

amount on line 8. Because you are reducing the

Line 15: Add amounts on lines 7 through 13 to determine

allowable loss shown on line 7 by the amounts shown

the modified taxable income and enter the result on

on succeeding lines, the amount entered will be a

line 15 (cannot be less than zero). NOTE: Line 7 may

positive figure.

1

1 2

2 3

3 4

4