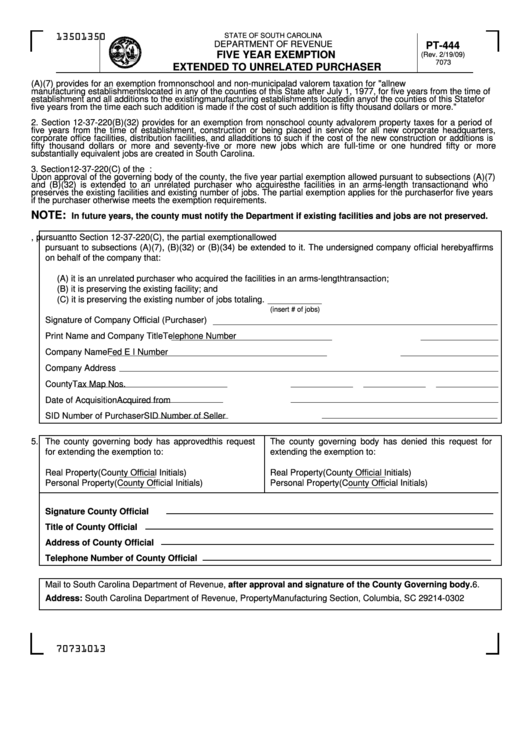

Form Pt-444 - Five Year Exemption Extended To Unrelated Purchaser

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

PT-444

FIVE YEAR EXEMPTION

(Rev. 2/19/09)

7073

EXTENDED TO UNRELATED PURCHASER

1. Section 12-37-220(A)(7) provides for an exemption from nonschool and non-municipal ad valorem taxation for "all new

manufacturing establishments located in any of the counties of this State after July 1, 1977, for five years from the time of

establishment and all additions to the existing manufacturing establishments located in any of the counties of this State for

five years from the time each such addition is made if the cost of such addition is fifty thousand dollars or more."

2. Section 12-37-220(B)(32) provides for an exemption from nonschool county ad valorem property taxes for a period of

five years from the time of establishment, construction or being placed in service for all new corporate headquarters,

corporate office facilities, distribution facilities, and all additions to such if the cost of the new construction or additions is

fifty thousand dollars or more and seventy-five or more new jobs which are full-time or one hundred fifty or more

substantially equivalent jobs are created in South Carolina.

3. Section 12-37-220(C) of the S.C. Code provides:

Upon approval of the governing body of the county, the five year partial exemption allowed pursuant to subsections (A)(7)

and (B)(32) is extended to an unrelated purchaser who acquires the facilities in an arms-length transaction and who

preserves the existing facilities and existing number of jobs. The partial exemption applies for the purchaser for five years

if the purchaser otherwise meets the exemption requirements.

NOTE:

In future years, the county must notify the Department if existing facilities and jobs are not preserved.

4. The undersigned company/corporation requests that, pursuant to Section 12-37-220(C), the partial exemption allowed

pursuant to subsections (A)(7), (B)(32) or (B)(34) be extended to it. The undersigned company official hereby affirms

on behalf of the company that:

(A) it is an unrelated purchaser who acquired the facilities in an arms-length transaction;

(B) it is preserving the existing facility; and

(C) it is preserving the existing number of jobs totaling

.

(insert # of jobs)

Signature of Company Official (Purchaser)

Print Name and Company Title

Telephone Number

Company Name

Fed E I Number

Company Address

County

Tax Map Nos.

Date of Acquisition

Acquired from

SID Number of Purchaser

SID Number of Seller

5.

The county governing body has approved this request

The county governing body has denied this request for

for extending the exemption to:

extending the exemption to:

Real Property

(County Official Initials)

Real Property

(County Official Initials)

Personal Property

(County Official Initials)

Personal Property

(County Official Initials)

Signature County Official

Title of County Official

Address of County Official

Telephone Number of County Official

6.

Mail to South Carolina Department of Revenue, after approval and signature of the County Governing body.

Address: South Carolina Department of Revenue, Property Manufacturing Section, Columbia, SC 29214-0302

70731013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1