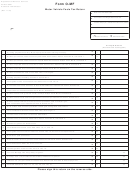

Form Pt-441 - Motor Carriers Property Tax Return Page 3

ADVERTISEMENT

State of South Carolina

Department of Revenue

300A Outlet Pointe Blvd., Columbia, South Carolina 29210

P.O. Box 125, Columbia, South Carolina 29214

SOUTH CAROLINA MOTOR CARRIER PROPERTY TAX

INFORMATION SHEET

Calendar Year, Due Date, Vehicles to Be Included

The motor carrier property tax return for the calendar year 2013 is due by June 30, 2014. The return should include all

vehicles with a gross vehicle weight (GVW) greater than 26,000 pounds and buses for hire registered with a Basic

Common Carrier (BC) tag designed to carry 16 or more passengers including the driver. Inter-City buses are excluded.

The property tax is based on ownership of a vehicle as of December 31, 2013. Property tax is due on any vehicle

owned or leased as of December 31, 2013 even if the vehicle did not have a tag or was not in use. All vehicles owned

as of December 31, 2013 should be reported on this tax return. Do not include vehicles purchased in 2014. All returns

are subject to audit by the Department of Revenue. Failure to file the form PT-441 or pay motor carrier property

tax will result in suspension of tags and driver's license.

Please use Black Ink only when completing the form PT-441.

Tags Types and Changes

Vehicles registered with SM tags should be assessed and paid at the county level. These vehicles should not be

included on the PT-441.

Starting with calendar year 2000, there is no weight class for farm tags with the Department of Revenue. If the

vehicle(s) have FM tags, the property taxes should be assessed and paid at the county level.

If you dropped the registered gross vehicle weight to 26,000 pounds or less or changed to an FM or SM tag in 2013,

please attach a copy of your paid tax receipt for 2013 and a copy of the registration to the PT-441 and send it back with

a request to close.

Federal Employer Identification Number (FEIN)/Social Security Number (SSN)

A return cannot be processed without a FEIN or SSN The number provided should be for the owner of the vehicle. All

type corporations and partnerships should provide the FEIN. Individuals and sole proprietors should provide their SSN

and FEIN if one has been assigned to them. This number is also required because it will allow the Department of

Revenue to continue to pursue a method to consolidate the vehicle file.

Filing One Return For All Vehicles

The Department of Revenue is still working to consolidate the file received from the Department of Public Safety so

that vehicle owners may file only one return for all vehicles required to be reported. Because of the different names

used to register vehicles and the lack of valid FEIN/SSN, more than one return may have been received. DO NOT

throw any tax returns away.

If more than one return is received, please use the one with the file number you filed under for tax year 2012. All

vehicles MUST be reported on one return. If this is the first time you filed and you received more than one return,

please use the return with the most correct information and indicate on the others the file number you filed under.

(Example: All information reported on DOR #31000333-7). Make sure that the name, address and FEIN/SSN is

correct. If this information is not correct, make the corrections on the tax return prior to filing.

All other returns received must be returned indicating across the top of the return the file number that you

filed under.

70851027

PT-460 7085 (Rev. 3/7/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4