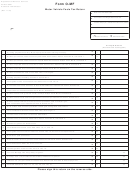

Form Pt-441 - Motor Carriers Property Tax Return Page 4

ADVERTISEMENT

Line 4 Mileage

If you claim out of state mileage you must attach a copy of your IFTA report for all four quarters of 2013. If you are

leased on to a company you must send in verification from the company you are leased on to. Submit vehicle, driver

and mileage information on letterhead from the company you are leased on to with a contact person’s name and

number. Driver information must include name, address and social security number. Vehicle information must include

year, make, model and VIN. Mileage information must include South Carolina mileage and total miles driven in all

jurisdictions for the vehicle being filed for only.

Vehicle Sold

If the vehicle(s) have been sold on or prior to December 31, 2013 please attach a copy of the Bill of Sale to the PT-441

and return to this office. If the vehicle(s) were not sold until the year 2014 the property tax for tax year 2013 is due.

The motor carrier property tax is based on ownership as of December 31.

Vehicle Repossessed

If the vehicle was repossessed prior to December 31, 2013, you will need to attach written confirmation from the

financial institution as to the day the vehicle was picked up and when they regained possession of the vehicle. If the

vehicle was repossessed after December 31, 2013, the return and payment for 2013 are still due.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state

to use an individual's social security number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SC Department of Revenue shall provide

identifying numbers, as prescribed, for securing proper identification. Your social security number is used for

identification purposes.

Property Taxes Charged By County

If the county charged property taxes for vehicles required to be reported on this return, you should contact the county

auditor's office to request a refund from the county. No credit is allowed on the Motor Carrier Property Tax return for

taxes paid to the county.

Payment of Property Tax

If a return is filed by June 30, 2014 the law allows for a split payment of the tax. No less than one-half must be

remitted with return and the balance of the tax due must be paid on or before December 31, 2014. Please mark

your calendar for second half payment. The Department of Revenue is not responsible for reminding you of this

payment.

Application for Motor Carrier Property Tax Form PT-442

New accounts are asked to complete the enclosed PT-442 so our records can be updated. The PT-442 must be sent

when filing the Motor Carrier Property Tax Return PT-441.

Record Keeping

Keep a copy of all returns filed with the Department of Revenue and keep records to substantiate information included

on the return. Records should be kept for at least three years.

Schedule PT-453 (VIN Schedule)

Complete Purchase date and Purchase price for all listed vehicles. Any vehicles you may own with a GVW greater

than 26,000 pounds that are not listed, should be added to the schedule and all columns completed. When you file the

PT-441 include the completed PT-453 with any bills of sale or any other documentation referencing any information

pertaining to vehicle(s).

Make all checks, cashier's checks and money orders payable to the SC Department of Revenue.

Telephone Number

Mailing Address

For assistance call

(803) 898-5222

SC Department of Revenue

MC Property Tax

Columbia SC 29214-0139

70852025

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4