1501210056

PA SCHEDULE A

Interest Income

PA-40 Schedule A

2015

(08-15) (FI)

OFFICIAL USE ONLY

START

Name shown first on the PA-40 (if filing jointly)

Social Security Number (shown first)

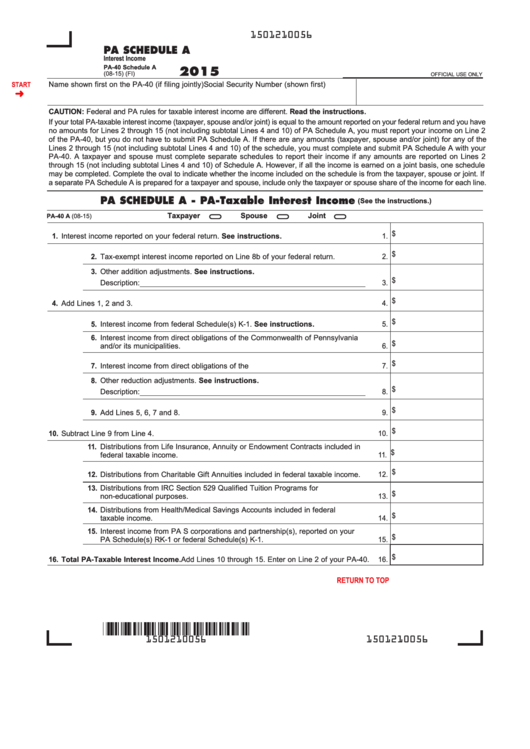

CAUTION: Federal and PA rules for taxable interest income are different. Read the instructions.

If your total PA-taxable interest income (taxpayer, spouse and/or joint) is equal to the amount reported on your federal return and you have

no amounts for Lines 2 through 15 (not including subtotal Lines 4 and 10) of PA Schedule A, you must report your income on Line 2

of the PA-40, but you do not have to submit PA Schedule A. If there are any amounts (taxpayer, spouse and/or joint) for any of the

Lines 2 through 15 (not including subtotal Lines 4 and 10) of the schedule, you must complete and submit PA Schedule A with your

PA-40. A taxpayer and spouse must complete separate schedules to report their income if any amounts are reported on Lines 2

through 15 (not including subtotal Lines 4 and 10) of Schedule A. However, if all the income is earned on a joint basis, one schedule

may be completed. Complete the oval to indicate whether the income included on the schedule is from the taxpayer, spouse or joint. If

a separate PA Schedule A is prepared for a taxpayer and spouse, include only the taxpayer or spouse share of the income for each line.

PA SCHEDULE A - PA-Taxable Interest Income

(See the instructions.)

Taxpayer

Spouse

Joint

PA-40 A (08-15)

1. $

1. Interest income reported on your federal return. See instructions.

2. $

2. Tax-exempt interest income reported on Line 8b of your federal return.

3. Other addition adjustments. See instructions.

3. $

Description:

4. $

4. Add Lines 1, 2 and 3.

5. $

5. Interest income from federal Schedule(s) K-1. See instructions.

6. Interest income from direct obligations of the Commonwealth of Pennsylvania

6. $

and/or its municipalities.

7. $

7. Interest income from direct obligations of the U.S. government.

8. Other reduction adjustments. See instructions.

8. $

Description:

9. $

9. Add Lines 5, 6, 7 and 8.

10. $

10. Subtract Line 9 from Line 4.

11. Distributions from Life Insurance, Annuity or Endowment Contracts included in

11. $

federal taxable income.

12. $

12. Distributions from Charitable Gift Annuities included in federal taxable income.

13. Distributions from IRC Section 529 Qualified Tuition Programs for

13. $

non-educational purposes.

14. Distributions from Health/Medical Savings Accounts included in federal

14. $

taxable income.

15. Interest income from PA S corporations and partnership(s), reported on your

15. $

PA Schedule(s) RK-1 or federal Schedule(s) K-1.

16. $

16. Total PA-Taxable Interest Income. Add Lines 10 through 15. Enter on Line 2 of your PA-40.

PRINT FORM

Reset Entire Form

RETURN TO TOP

1501210056

1501210056

1

1