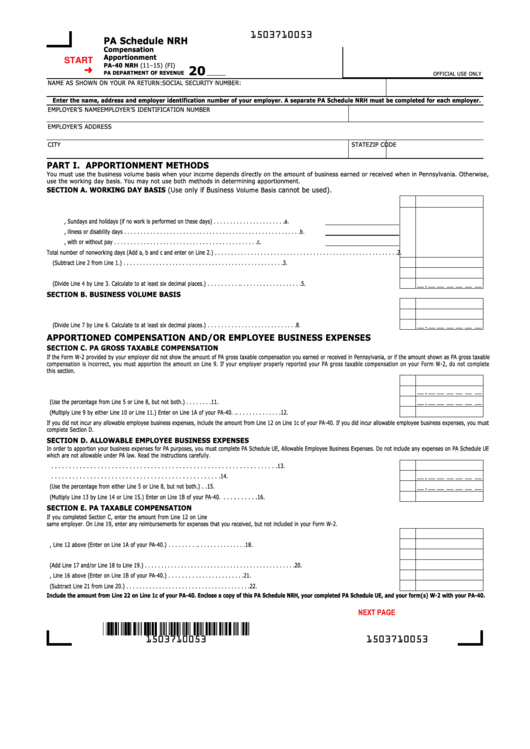

1503710053

PA Schedule NRH

Compensation

Apportionment

START

PA-40 NRH (11–15) (FI)

20

PA DEPARTMENT OF REVENUE

OFFICIAL USE ONLY

NAME AS SHOWN ON YOUR PA RETURN:

SOCIAL SECURITY NUMBER:

Enter the name, address and employer identification number of your employer. A separate PA Schedule NRH must be completed for each employer.

EMPLOYER’S NAME

EMPLOYER’S IDENTIFICATION NUMBER

EMPLOYER’S ADDRESS

CITY

STATE

ZIP CODE

PART I. APPORTIONMENT METHODS

You must use the business volume basis when your income depends directly on the amount of business earned or received when in Pennsylvania. Otherwise,

use the working day basis. You may not use both methods in determining apportionment.

SECTION A. WORKING DAY BASIS (Use only if Business

cannot be used).

Volume Basis

1. Total number of days in the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Total number of nonworking days

a. Saturdays, Sundays and holidays (if no work is performed on these days) . . . . . . . . . . . . . . . . . . . . . .a.

b. Sick, illness or disability days . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .b.

c. Vacation or leave days, with or without pay . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .c.

Total number of nonworking days (Add a, b and c and enter on Line 2.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Total number of days worked in the tax year (Subtract Line 2 from Line 1.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Total number of days worked within Pennsylvania during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Working days apportionment fraction (Divide Line 4 by Line 3. Calculate to at least six decimal places.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

.

SECTION B. BUSINESS VOLUME BASIS

6. Total volume of business transacted during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Total volume of business transacted directly due to activity in Pennsylvania . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

.

8. Business volume apportionment fraction (Divide Line 7 by Line 6. Calculate to at least six decimal places.) . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

APPORTIONED COMPENSATION AND/OR EMPLOYEE BUSINESS EXPENSES

SECTION C. PA GROSS TAXABLE COMPENSATION

If the Form W-2 provided by your employer did not show the amount of PA gross taxable compensation you earned or received in Pennsylvania, or if the amount shown as PA gross taxable

compensation is incorrect, you must apportion the amount on Line 9. If your employer properly reported your PA gross taxable compensation on your Form W-2, do not complete

this section.

9. Gross taxable compensation from Form W-2 or pay stubs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

.

10. Working days apportionment percentage from Line 5 in Section A above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

.

11. Business volume apportionment percentage from Line 8 in Section B above (Use the percentage from Line 5 or Line 8, but not both.) . . . . . . . .

11.

12. Apportioned PA gross taxable compensation (Multiply Line 9 by either Line 10 or Line 11.) Enter on Line 1A of your PA-40. . . . . . . . . . . . . . . .

12.

If you did not incur any allowable employee business expenses, include the amount from Line 12 on Line 1c of your PA-40. If you did incur allowable employee business expenses, you must

complete Section D.

SECTION D. ALLOWABLE EMPLOYEE BUSINESS EXPENSES

In order to apportion your business expenses for PA purposes, you must complete PA Schedule UE, Allowable Employee Business Expenses. Do not include any expenses on PA Schedule UE

which are not allowable under PA law. Read the instructions carefully.

13. Total allowable expenses from PA Schedule UE

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Working day apportionment percentage from Line 5 in Section A above

14.

.

. .

15. Business volume apportionment percentage from Line 8 in Section B above (Use the percentage from either Line 5 or Line 8, but not both.)

15.

16. Apportioned PA allowable employee business expenses (Multiply Line 13 by Line 14 or Line 15.) Enter on Line 1B of your PA-40.

. . . . . . . . . .

16.

SECTION E. PA TAXABLE COMPENSATION

If you completed Section C, enter the amount from Line 12 on Line 18.You should not have amounts on both Line 17 and Line 18 unless you received more than one Form W-2 from the

same employer. On Line 19, enter any reimbursements for expenses that you received, but not included in your Form W-2.

17. Correct PA gross taxable compensation from Form W-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

18. Apportioned PA gross taxable compensation from Section C, Line 12 above (Enter on Line 1A of your PA-40.) . . . . . . . . . . . . . . . . . . . . . . . .

18.

19. Apportioned reimbursements for expenses not included in your Form W-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.

20. Total PA gross taxable compensation (Add Line 17 and/or Line 18 to Line 19.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20.

21. Apportioned PA employee business expenses from Section D, Line 16 above (Enter on Line 1B of your PA-40.) . . . . . . . . . . . . . . . . . . . . . . .

21.

22. Net taxable/apportioned PA gross taxable compensation (Subtract Line 21 from Line 20.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22.

Include the amount from Line 22 on Line 1c of your PA-40. Enclose a copy of this PA Schedule NRH, your completed PA Schedule UE, and your form(s) W-2 with your PA-40.

Reset Entire Form

NEXT PAGE

PRINT FORM

1503710053

1503710053

1

1 2

2 3

3 4

4