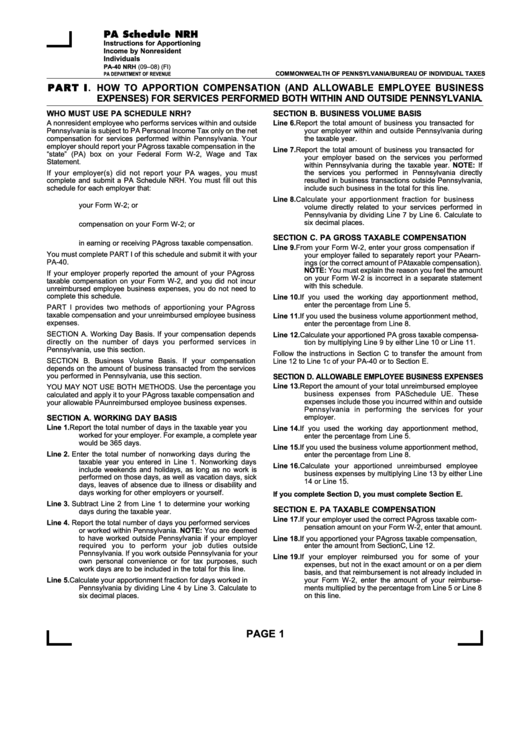

PA Schedule NRH

Instructions for Apportioning

Income by Nonresident

Individuals

PA-40 NRH (09–08) (FI)

COMMONWEALTH OF PENNSYLVANIA/BUREAU OF INDIVIDUAL TAXES

PA DEPARTMENT OF REVENUE

PART I. HOW TO APPORTION COMPENSATION (AND ALLOWABLE EMPLOYEE BUSINESS

EXPENSES) FOR SERVICES PERFORMED BOTH WITHIN AND OUTSIDE PENNSYLVANIA.

WHO MUST USE PA SCHEDULE NRH?

SECTION B. BUSINESS VOLUME BASIS

A nonresident employee who performs services within and outside

Line 6.

Report the total amount of business you transacted for

Pennsylvania is subject to PA Personal Income Tax only on the net

your employer within and outside Pennsylvania during

compensation for services performed within Pennsylvania. Your

the taxable year.

employer should report your PA gross taxable compensation in the

Line 7.

Report the total amount of business you transacted for

“state” (PA) box on your Federal Form W-2, Wage and Tax

your employer based on the services you performed

Statement.

within Pennsylvania during the taxable year. NOTE: If

If your employer(s) did not report your PA wages, you must

the services you performed in Pennsylvania directly

complete and submit a PA Schedule NRH. You must fill out this

resulted in business transactions outside Pennsylvania,

schedule for each employer that:

include such business in the total for this line.

a. Did not report your PA gross taxable compensation on

Line 8.

Calculate your apportionment fraction for business

your Form W-2; or

volume directly related to your services performed in

Pennsylvania by dividing Line 7 by Line 6. Calculate to

b. Reported an incorrect amount as PA gross taxable

six decimal places.

compensation on your Form W-2; or

c. You incurred unreimbursed employee business expenses

SECTION C. PA GROSS TAXABLE COMPENSATION

in earning or receiving PA gross taxable compensation.

Line 9.

From your Form W-2, enter your gross compensation if

You must complete PART I of this schedule and submit it with your

your employer failed to separately report your PA earn-

PA-40.

ings (or the correct amount of PA taxable compensation).

NOTE: You must explain the reason you feel the amount

If your employer properly reported the amount of your PA gross

on your Form W-2 is incorrect in a separate statement

taxable compensation on your Form W-2, and you did not incur

with this schedule.

unreimbursed employee business expenses, you do not need to

complete this schedule.

Line 10. If you used the working day apportionment method,

enter the percentage from Line 5.

PART I provides two methods of apportioning your PA gross

taxable compensation and your unreimbursed employee business

Line 11. If you used the business volume apportionment method,

expenses.

enter the percentage from Line 8.

SECTION A. Working Day Basis. If your compensation depends

Line 12. Calculate your apportioned PA gross taxable compensa-

directly on the number of days you performed services in

tion by multiplying Line 9 by either Line 10 or Line 11.

Pennsylvania, use this section.

Follow the instructions in Section C to transfer the amount from

SECTION B. Business Volume Basis. If your compensation

Line 12 to Line 1c of your PA-40 or to Section E.

depends on the amount of business transacted from the services

you performed in Pennsylvania, use this section.

SECTION D. ALLOWABLE EMPLOYEE BUSINESS EXPENSES

Line 13. Report the amount of your total unreimbursed employee

YOU MAY NOT USE BOTH METHODS. Use the percentage you

business expenses from PA Schedule UE. These

calculated and apply it to your PA gross taxable compensation and

expenses include those you incurred within and outside

your allowable PA unreimbursed employee business expenses.

Pennsylvania in performing the services for your

employer.

SECTION A. WORKING DAY BASIS

Line 1.

Report the total number of days in the taxable year you

Line 14. If you used the working day apportionment method,

worked for your employer. For example, a complete year

enter the percentage from Line 5.

would be 365 days.

Line 15. If you used the business volume apportionment method,

Line 2.

Enter the total number of nonworking days during the

enter the percentage from Line 8.

taxable year you entered in Line 1. Nonworking days

Line 16. Calculate your apportioned unreimbursed employee

include weekends and holidays, as long as no work is

business expenses by multiplying Line 13 by either Line

performed on those days, as well as vacation days, sick

14 or Line 15.

days, leaves of absence due to illness or disability and

days working for other employers or yourself.

If you complete Section D, you must complete Section E.

Line 3.

Subtract Line 2 from Line 1 to determine your working

SECTION E. PA TAXABLE COMPENSATION

days during the taxable year.

Line 17. If your employer used the correct PA gross taxable com-

Line 4.

Report the total number of days you performed services

pensation amount on your Form W-2, enter that amount.

or worked within Pennsylvania. NOTE: You are deemed

to have worked outside Pennsylvania if your employer

Line 18. If you apportioned your PA gross taxable compensation,

required you to perform your job duties outside

enter the amount from Section C, Line 12.

Pennsylvania. If you work outside Pennsylvania for your

Line 19. If your employer reimbursed you for some of your

own personal convenience or for tax purposes, such

expenses, but not in the exact amount or on a per diem

work days are to be included in the total for this line.

basis, and that reimbursement is not already included in

Line 5.

Calculate your apportionment fraction for days worked in

your Form W-2, enter the amount of your reimburse-

Pennsylvania by dividing Line 4 by Line 3. Calculate to

ments multiplied by the percentage from Line 5 or Line 8

six decimal places.

on this line.

PAGE 1

1

1 2

2 3

3 4

4