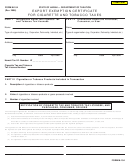

FORM M-104

INSTRUCTIONS

(Rev. 2013)

GENERAL INFORMATION

PURPOSE OF THIS

WHERE TO FILE THE

CERTIFICATE

CERTIFICATE

Section 245-32, Hawaii Revised

Statutes (HRS), provides for a cigarette

Form M-104, Export Exemption

The certificate must be attached to the

and tobacco tax refund or credit to a li-

Certificate for Cigarette and Tobacco

cigarette tax and tobacco tax licensee’s

censee who has paid a cigarette or to-

Taxes, must be completed in order for

Form M-19, Cigarette and Tobacco

bacco tax on the distribution of ciga-

the cigarette tax and tobacco tax li-

Products Monthly Tax Return, when

rettes or tobacco products that are

censee to claim a (1) cigarette tax re-

claiming a refund of cigarette taxes

shipped to a point outside the State for

fund, or (2) tobacco tax exemption on

paid with cigarette tax stamps. The cer-

subsequent sale or use outside the

the distribution of cigarettes or tobacco

tificate does not need to be attached to

State.

products that are shipped to a point

Form M-19 when claiming a tobacco

outside the State for subsequent sale

tax exemption. Instead, the certificate

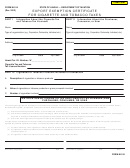

ADDITIONAL INFORMATION

or use outside the State. Form M-104

must be retained at the cigarette tax

Export and Foreign Cigarettes

must also be completed for sales made

and tobacco tax licensee’s place of

Prohibited

under section 212-8, HRS, to any com-

business.

mon carrier for consumption out-of-

WHERE TO GET INFORMATION

It is unlawful for an entity to pos-

state by the crew or passengers on

sess, keep, store, retain, transport, sell,

such carrier, and for sales by wholesal-

Oahu District Office

or offer to sell, distribute, acquire, hold,

ers from U.S. licensed bonded ware-

830 Punchbowl Street

own, import, or cause to be imported

houses to foreign fishing vessels and to

P. O. Box 259

into the State any of the cigarettes de-

common carriers for out-of-state con-

Honolulu, HI 96809-0259

scribed in section 245-51, HRS.

sumption by the crew or passengers.

Tel. No.: (808) 587-4242

Stamping or Sale of Cigarettes

This form must be a part of each order

Toll Free: 1-800-222-3229

Not Listed in the Directory

or contract of sale between the ciga-

Maui District Office

Prohibited

rette tax and tobacco tax licensee; and

54 S. High St., #208

purchaser, consumer, or user who are

Beginning December 1, 2003, un-

Wailuku, HI 96793-2198

signatories to the certificate. In the

less the cigarette package is exempted

Toll Free: 1-800-222-3229

event Form M-104 is impracticable to

under section 245-3(b), HRS, it is un-

complete, an alternative form or docu-

Hawaii District Office

lawful (a) to affix a cigarette tax stamp

ment may be used provided the infor-

75 Aupuni St., #101

to any cigarette package whose tobac-

mation requested in Parts I, II, and III of

Hilo, HI 96720-4245

co product manufacturer or brand fam-

Form M-104 are maintained.

Toll Free: 1-800-222-3229

ily is not listed in the directory estab-

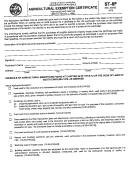

SPECIFIC INSTRUCTIONS

lished under chapter 486P, HRS, or (b)

Kauai District Office

to import, sell, offer, keep, store, ac-

3060 Eiwa St., #105

Part I

quire, transport, distribute, receive, or

Lihue, HI 96766-1889

possess for sale or distribution ciga-

Enter information regarding the ciga-

Toll Free: 1-800-222-3229

rettes of a tobacco product manufac-

rette tax and tobacco tax licensee.

turer or brand family not included in the

Part II

directory. Any violation will be guilty of a

class C felony.

Enter information regarding the pur-

chaser, consumer, or user.

To determine whether the cigarette

manufacturer or brand family is listed in

Part III

such directory, please visit the Tobacco

Enter information regarding the ciga-

Enforcement Unit, Department of the

rettes or tobacco products involved in

Attorney

General’s

website

at:

this transaction.

ag.hawaii.gov/cjd/tobacco-enforcement-unit

SIGNING OF THE CERTIFICATE

The Tobacco Enforcement Unit also

may be contacted as follows:

The certificate shall be dated, execut-

ed, and signed by both the cigarette tax

Correspondence:

and tobacco tax licensee; and the pur-

TOBACCO ENFORCEMENT UNIT

chaser, consumer, or user.

Department of the Attorney General

425 Queen Street

Honolulu, Hawaii 96813

Telephone: (808) 586-1203

1

1 2

2