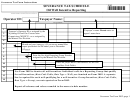

Form 2000 - Severance Tax Report Oil Page 4

ADVERTISEMENT

O - Original

Form Type:

Taxpayer Name:

A - Amended

Contact Name:

Contact Phone Number:

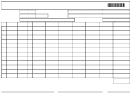

PRODUCTION

REPORTING

RATE

GROSS SALES

GROSS SALES

EXEMPT

TAXABLE

TOTAL TAX DUE

PERIOD

GROUP

CODE

VOLUME

VALUE

ROYALTY AND

VALUE

(mmyyyy)

NUMBER

TRANSPORTATION

NOTE: For amended returns

1

Equals the taxable value times the applicable tax rate per the Rate Code Table.

(Form Type ‘A’) report

VALUES ONLY.

2

3

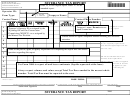

Severance Rate Code Table for Oil

NOTE: A change in Rate Code

4

Rate

Rate

Severance

requires BOTH an amended

Code

Mineral

Type

Description

Tax Rate

for the originally reported rate

5

BAS

Oil

Group

No Incentives (base rate)

.060

code and an original report for the

S10

Oil

Group

Stripper up to 10 barrels per day

.040

new rate code.

6

S15

Oil

Group

Stripper between 11 bbls and 15 bbls per day

.040

7

LCD

Oil

Group

Lease Condensate

.060

REN

Oil

Well

Renewed Production

.015

NOTE: For amendments Total

8

NOTE: Reporting Groups containing wells that qualify for well incentives, Rate Type “Well”, must

Tax Due is the replacement

complete and attach 2002, Severance Tax Schedule.

will not reflect previous tax applied

9

to your account. Be sure to account

for tax previously applied to your

10

account prior to remitting the

current payment.

11

12

MTSII 10/8/01

PAGE TOTAL:

I declare under penalty of perjury that I have examined this return and, to the best of my knowledge and belief, it is correct and complete.

Authorized Signature

Title

Date

State of Wyoming

2000

SEVERANCE TAX REPORT

Department of Revenue

*2000*

122 West 25th Street

OIL

Cheyenne WY 82002-0110

DEPARTMENT OF REVENUE USE ONLY:

Operator ID:

O - Original

Form Type:

Taxpayer Name:

A - Amended

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6