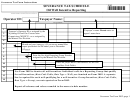

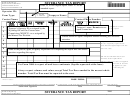

Form 2000 - Severance Tax Report Oil Page 5

ADVERTISEMENT

Contact Name:

Contact Phone Number:

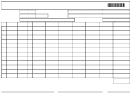

PRODUCTION

REPORTING

RATE

GROSS SALES

GROSS SALES

EXEMPT

TAXABLE

TOTAL TAX DUE

PERIOD

GROUP

CODE

VOLUME

VALUE

ROYALTY AND

VALUE

(mmyyyy)

NUMBER

TRANSPORTATION

NOTE: For amended returns

1

(Form Type ‘A’) report

th

Severance Tax Forms and payment in full must be post-marked by the 25

day of

VALUES ONLY.

2

the second month following the month of production. If a taxpayer’s total liability

for severance tax was less than $30,000 for the preceding calendar year, the

3

taxpayer can report annually, by February 25th of the year following the

NOTE: A change in Rate Code

4

production year. All delinquent severance taxes are subject to penalty and

requires BOTH an amended

interest.

for the originally reported rate

5

code and an original report for the

new rate code.

6

The mailing address for all Department of Revenue mineral forms is:

7

Wyoming Department of Revenue

NOTE: For amendments Total

8

Mineral Tax Division

Tax Due is the replacement

122 West 25th Street

will not reflect previous tax applied

9

to your account. Be sure to account

Cheyenne, WY 82002-0110

for tax previously applied to your

10

account prior to remitting the

current payment.

11

All paper forms must be signed and dated originals.

12

MTSII 10/8/01

PAGE TOTAL:

I declare under penalty of perjury that I have examined this return and, to the best of my knowledge and belief, it is correct and complete.

Authorized Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6