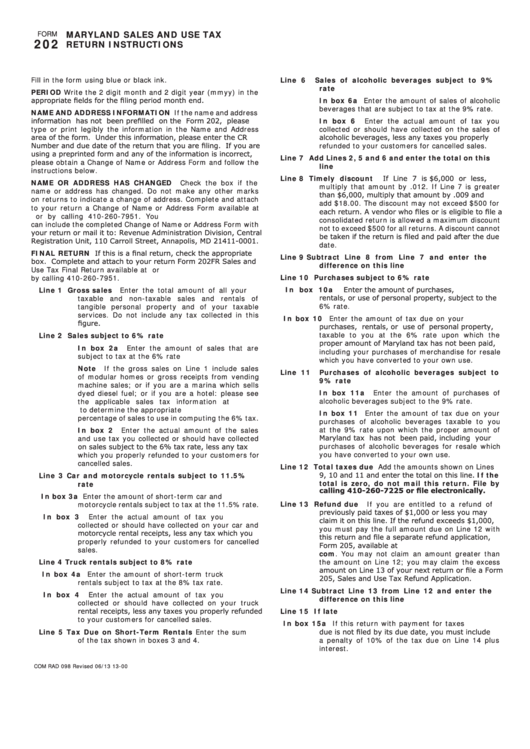

Form 202 - Maryland Sales And Use Tax Return Instructions

ADVERTISEMENT

MARYLAND SALES AND USE TAX

FORM

202

RETURN INSTRUCTIONS

Fill in the form using blue or black ink.

Line 6

Sales of alcoholic beverages subject to 9%

rate

PERIOD Write the 2 digit month and 2 digit year (mmyy) in the

appropriate fields for the filing period month end.

In box 6a Enter the amount of sales of alcoholic

beverages that are subject to tax at the 9% rate.

NAME AND ADDRESS INFORMATION If the name and address

information has not been prefilled on the Form 202, please

In box 6

Enter the actual amount of tax you

type or print legibly the information in the Name and Address

collected or should have collected on the sales of

area of the form. Under this information, please enter the CR

alcoholic beverages, less any taxes you properly

Number and due date of the return that you are filing. If you are

refunded to your customers for cancelled sales.

using a preprinted form and any of the information is incorrect,

Line 7

Add Lines 2, 5 and 6 and enter the total on this

please obtain a Change of Name or Address Form and follow the

line

instructions below.

Line 8

Timely discount

If Line 7 is $6,000 or less,

NAME OR ADDRESS HAS CHANGED

Check the box if the

multiply that amount by .012. If Line 7 is greater

name or address has changed. Do not make any other marks

than $6,000, multiply that amount by .009 and

on returns to indicate a change of address. Complete and attach

add $18.00. The discount may not exceed $500 for

to your return a Change of Name or Address Form available at

each return. A vendor who files or is eligible to file a

or by calling 410-260-7951. You

consolidated return is allowed a maximum discount

can include the completed Change of Name or Address Form with

not to exceed $500 for all returns. A discount cannot

your return or mail it to: Revenue Administration Division, Central

be taken if the return is filed and paid after the due

Registration Unit, 110 Carroll Street, Annapolis, MD 21411-0001.

date.

FINAL RETURN If this is a final return, check the appropriate

Line 9

Subtract Line 8 from Line 7 and enter the

box. Complete and attach to your return Form 202FR Sales and

difference on this line

Use Tax Final Return available at or

Line 10

Purchases subject to 6% rate

by calling 410-260-7951.

In box 10a

Enter the amount of purchases,

Line 1

Gross sales

Enter the total amount of all your

rentals, or use of personal property, subject to the

taxable and non-taxable sales and rentals of

6% rate.

tangible personal property and of your taxable

services. Do not include any tax collected in this

In box 10 Enter the amount of tax due on your

figure.

purchases, rentals, or use of personal property,

taxable to you at the 6% rate upon which the

Line 2

Sales subject to 6% rate

proper amount of Maryland tax has not been paid,

In box 2a

Enter the amount of sales that are

including your purchases of merchandise for resale

subject to tax at the 6% rate

which you have converted to your own use.

Note

If the gross sales on Line 1 include sales

Line 11

Purchases of alcoholic beverages subject to

of modular homes or gross receipts from vending

9% rate

machine sales; or if you are a marina which sells

In box 11a

Enter the amount of purchases of

dyed diesel fuel; or if you are a hotel: please see

alcoholic beverages subject to the 9% rate.

the applicable sales tax information at www.

to determine the appropriate

In box 11 Enter the amount of tax due on your

percentage of sales to use in computing the 6% tax.

purchases of alcoholic beverages taxable to you

at the 9% rate upon which the proper amount of

In box 2

Enter the actual amount of the sales

Maryland tax has not been paid, including your

and use tax you collected or should have collected

purchases of alcoholic beverages for resale which

on sales subject to the 6% tax rate, less any tax

you have converted to your own use.

which you properly refunded to your customers for

cancelled sales.

Line 12

Total taxes due Add the amounts shown on Lines

9, 10 and 11 and enter the total on this line. If the

Line 3

Car and motorcycle rentals subject to 11.5%

total is zero, do not mail this return. File by

rate

calling 410-260-7225 or file electronically.

In box 3a Enter the amount of short-term car and

Line 13

Refund due

If you are entitled to a refund of

motorcycle rentals subject to tax at the 11.5% rate.

previously paid taxes of $1,000 or less you may

In box 3

Enter the actual amount of tax you

claim it on this line. If the refund exceeds $1,000,

collected or should have collected on your car and

you must pay the full amount due on Line 12 with

motorcycle rental receipts, less any tax which you

this return and file a separate refund application,

properly refunded to your customers for cancelled

Form 205, available at

sales.

com. You may not claim an amount greater than

Line 4

Truck rentals subject to 8% rate

the amount on Line 12; you may claim the excess

amount on Line 13 of your next return or file a Form

In box 4a Enter the amount of short-term truck

205, Sales and Use Tax Refund Application.

rentals subject to tax at the 8% tax rate.

Line 14

Subtract Line 13 from Line 12 and enter the

In box 4

Enter the actual amount of tax you

difference on this line

collected or should have collected on your truck

rental receipts, less any taxes you properly refunded

Line 15

If late

to your customers for cancelled sales.

In box 15a If this return with payment for taxes

Line 5

Tax Due on Short-Term Rentals Enter the sum

due is not filed by its due date, you must include

of the tax shown in boxes 3 and 4.

a penalty of 10% of the tax due on Line 14 plus

interest.

COM RAD 098

Revised 06/13

13-00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2