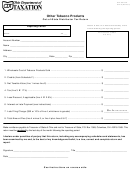

BOE-501-CT (S2) REV. 13 (4-13)

INSTRUCTIONS - TOBACCO PRODUCTS DISTRIBUTOR TAX RETURN

PREPARATION OF RETURN

Line 1A.

BOE-501-CTT, Tobacco Schedule T, is not required to be completed if you did not sell roll-your-own tobacco

from nonparticipating manufacturers for this reporting period.

Line 1.

Wholesale Cost of all Tobacco Products Distributed. Enter the wholesale cost, as defined, of untaxed tobacco

products that you distributed. Do not include the wholesale cost of tobacco products that were returned to you by

a customer during the same month covered by this return when you refund the entire amount the customer paid

for the tobacco products either in cash or credit. Refund or credit of the entire amount shall be deemed to be

given when the purchase price, less rehandling charges and restocking cost, is refunded or credited to a customer

[Revenue & Taxation Code section 30131.2(c)].

Note: A licensed California distributor may also be the original importer of tobacco products manufactured outside

of the U.S. (Revenue & Taxation Code section 30105). If you are the original importer of tobacco products

manufactured outside of the U.S. and sell these products to a licensed distributor, you must include those sales

on BOE-501-MIT, Schedule - Manufacturer/Importer Report of Tobacco Products Delivered or Shipped into

California. If you purchase tobacco products manufactured outside the U.S. from an original importer, you must

include the cost of the imported tobacco products on line 1 and pay the tax based on your distribution of the

imported products.

Line 2.

Interstate or Foreign Commerce. Enter the wholesale cost, as defined, of those tobacco products reported on

line 1 that were distributed to purchasers in other states, territories or foreign countries by delivery outside

California and not returned to this state before use.

Line 3.

Interstate or Foreign Passenger Common Carrier. Enter the wholesale cost, as defined, of those tobacco

products reported on line 1 that were distributed to a common carrier engaged in interstate or foreign passenger

service or to a person authorized to sell tobacco products on the facilities of such carriers.

Line 4.

Other Exemptions. Enter the wholesale cost, as defined, of only those tobacco products reported on line 1 that

are exempt from tax, such as: (1) tobacco products sold to the U.S. Army, Air Force, Navy, Marine Corps, or Coast

Guard exchanges and commissaries, and Navy or Coast Guard ships stores; (2) tobacco products under internal

revenue bond or customs control; or (3) tobacco products sold or transferred to a law enforcement agency for use

in a criminal investigation.

Caution: Sales by original importers of tobacco products manufactured outside the U.S. to licensed distributors

are not taxable (Revenue & Taxation Code section 30105) and must be included on BOE-501-MIT. If, however,

you are an original importer with sales to unlicensed distributors in California, or sales to wholesalers or retailers

of tobacco products, you must include the sales on line 1.

Line 5.

Credit on Returned Tobacco Products Where Tax Was Reported in a Prior Month. Enter the wholesale cost,

as defined, of those tobacco products that were returned by the customer during the period covered by this return

but that were reported on line 1 for a different month than covered by this return. Credit of the entire amount shall

be deemed to be given when the entire purchase price, less rehandling and restocking costs, is credited to the

customer (Revenue & Taxation Code section 30176.2). If the credit exceeds the liability on line 12, the balance will

be refunded.

Lines 10

Payment after the Due Date. If you are paying the tax after the due date shown on the front of this return,

and 11.

additional amounts are due for penalty and interest charges. The penalty is 10 percent (0.10) of the amount of tax

owing. The interest rate for late payment is noted on line 11 on the front of this form and applies for each month or

portion of a month after the due date.

Line 12.

Amount Due. Enter the total amount due and payable including penalty and interest, if applicable.

If you need additional information, please contact the State Board of Equalization, Special Taxes and Fees, P.O. Box 942879,

Sacramento, CA 94279-0088. You may also visit the BOE website at or call the Taxpayer Information Section at

1-800-400-7115 (TTY:711); from the main menu, select the option Special Taxes and Fees.

1

1 2

2 3

3