Special Reporting Periods for Sales and Use Tax

May I apply for special reporting periods for multiple accounts?

Yes, provided you list all account numbers on your request form or an attachment. If you wish to

add additional accounts to an approved special reporting period schedule, you must submit a new

BOE-715. We will not automatically assign or approve special reporting periods for new or additional

accounts based on a previously approved request.

What if I do not receive a return in time to file by the due date?

If you receive an authorization letter but do not receive a tax return prior to a specified due date,

please contact your nearest Board office to request a return. Be sure to provide your business name and

account number so that the return will be created for your approved special reporting period. You are

responsible for filing returns and paying tax by the due dates listed in your authorization letter even

when you do not receive a return in the mail.

Can I change reporting periods or return to regular calendar reporting periods?

You may use BOE-715 to request a revision to your reporting periods or to request that you be returned

to regular calendar reporting periods. In either case, you must continue to file according to your

approved schedule until you receive written confirmation that your request for change or cancellation

has been approved.

Will I need to renew my request in the future?

Yes, unless you requested and received permanent approval of your special reporting periods. If you

do not request a permanent change, we will ordinarily approve your request only for those periods

you list on BOE-715. The form includes adequate space to list reporting periods for two years. (You

may submit a request that covers a longer period of time if you wish, provided all reporting periods are

listed.) Approximately 90 days before your approval expires, we will send you an expiration letter and

another request form. If you wish to continue to file returns for special reporting periods, you will need

to submit a new request at least 30 days prior to the expiration date noted in the letter.

Whom do I contact for more information?

The Board’s Return Analysis Unit is responsible for all special reporting period requests. For more

information, you may write to:

Return Analysis Unit

Attn: Special Reporting Desk

State Board of Equalization

P.O. Box 942879

Sacramento, CA 94279-0035

Or, for further assistance, you may call 916-445-7732 and ask for the Special Reporting Desk.

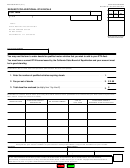

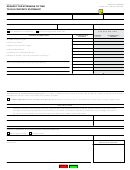

BOE-715 (S1B) REV. 2 (12-06)

1

1 2

2 3

3 4

4