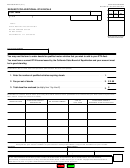

BOE-715 (S2B) REV. 2 (12-06)

INSTRUCTIONS

REQUEST FOR SPECIAL REPORTING PERIODS

SECTION I: ACCOUNT AND REQUEST INFORMATION (Must be completed for all requests.)

Please provide all information requested. If you are requesting a special schedule for more than one account, be sure

to list all account numbers. If necessary, a list may be attached to the request form.

Type of Action: (Check only one box.)

• NEW: If your request is new, or if you wish to add new accounts to an already-approved special reporting

schedule.

• REVISE: If you wish to revise a previously-approved special reporting schedule.

• EXTEND: If you wish to extend an approved special reporting schedule that is expiring.

• REMOVE: If you wish to be removed from your special reporting schedule.

Please indicate whether you are requesting a permanent change to your tax reporting periods by checking the

appropriate box. If you do not request a permanent change, your request will generally be approved only for those

periods you list on this form.

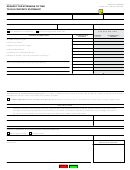

SECTION II: PROPOSED REPORTING PERIODS

Please complete Part A, B, or C, depending on your current filing basis. List your requested reporting periods for the

next two years with beginning and ending dates for each period. For example, if you currently file on a quarterly basis,

you must complete Part B and list four proposed quarterly periods for each year.

Note to accounts reporting on a quarterly prepayment basis - As required by law, the Board will adjust the length

of the second prepayment period of your second tax reporting quarter. The second prepayment period will be extended

by 15 days. Any adjustment will be noted on your authorization letter and the accompanying tax reporting calendar.

Example: If, for the second quarter, you request a second prepayment period beginning on May 3 and

ending on June 2, we will adjust the closing date of the period to June 17.

To expedite the processing of your request, please be sure to fully and accurately complete this form. Your form must

be signed by the business owner, or authorized representative, and dated. Please mail your completed request to:

Return Analysis Unit

Attn: Special Reporting Desk

State Board of Equalization

PO Box 942879

Sacramento, CA 94279-0035

1

1 2

2 3

3 4

4