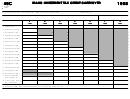

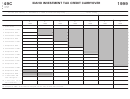

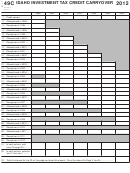

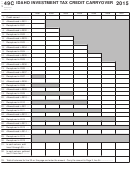

Form 49c - Idaho Investment Tax Credit Carryover - 2015 Page 3

ADVERTISEMENT

EFO00047p3

06-17-15

Instructions for Idaho Form 49C

GENERAL INSTRUCTIONS

Use of Other Schedules

If this form does not allow you to properly reflect the

Complete this form if an investment tax credit (ITC)

application of carryovers and recapture, provide the

carryover is included in the current year's available credit.

information on a separate schedule.

Once the Form 49C is completed, the carryover will be

SPECIFIC INSTRUCTIONS

carried to Form 49.

Carryover Period

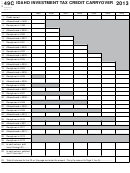

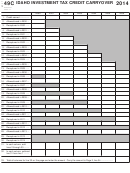

Line 1. For each year, enter the credit earned in that tax

ITC earned in tax years beginning on or after

year. Don't include any carryover amounts.

January 1, 2000, can be carried forward up to 14

succeeding tax years. Credit earned in tax years

Lines 2, 4, 6, 8, 10, 12, 14, 16, 18, 20, 22, 24, 26, and 28.

beginning before 2000 can also be carried forward up

For each year, enter the amount of credit allowed against

to 14 tax years if the 7-year carryover allowed for these

tax, the amount of credit you earned that was shared with

years didn't expire before the first tax year beginning in

another member of the unitary group, and the amount of

credit that passed through to an owner or beneficiary.

2000. For purposes of the carryover period, a short tax

year counts as one tax year.

Lines 3, 5, 7, 9, 11, 13, 15, 17, 19, 21, 23, 25, 27, 29,

Application of Credit

and 30.

The oldest available credit must be used before credit

For each year, enter the total of the following amounts:

● Credit recaptured. The credit must be recomputed

earned in the current year is used. Property moved from

Idaho within the first five years ceases to qualify as ITC

if you disposed of the property before the end of the

property and is subject to recapture.

5-year recapture period. This includes 100% of the

credit for property used less than a full year.

Unitary Taxpayers

Credit carried forward may be claimed by any member

of a unitary combined group of corporations as long as

the member who earned the credit is still in the combined

group for the year the credit is being claimed.

Conversion of a C Corporation to S Corporation

An investment tax credit carryover earned by a C

corporation that has converted to an S corporation is

allowed against the S corporation's tax on net recognized

built-in gains and excess net passive income. The credit

isn't allowed against the tax paid by an S corporation for

nonresident shareholders. A separate Form 49C should

be used to account for this credit carryover.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3