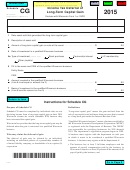

2015

Schedule CG and Instructions

Page 2 of 2

• The value of real and tangible personal property owned or

Line 7 The basis of the investment is calculated by subtracting

rented and used by the business in Wisconsin is equal to at

the deferred gain (line 3) from the amount of the investment in

least 50 percent of the value of all real and tangible personal

the qualified Wisconsin business (line 6). The reduced basis

property owned or rented and used by the business.

will result in a larger gain (or smaller loss) for Wisconsin than

for federal purposes when the investment is sold or otherwise

disposed of in the future.

Procedures

An individual may subtract from federal adjusted gross income

Note:

If you invested the deferred gain in a qualified

any amount of a long-term capital gain if the individual does

Wisconsin business and hold the investment for 5 years, if

all of the following:

certain conditions are met you may be able to exclude gain

from the sale or disposition of the investment. The business

• Within 180 days after the sale of the asset that generated

must have been certified by WEDC or registered with the

the gain, invests all of the long-term gain in a qualified

department for the year of the investment and for two of the

Wisconsin business.

subsequent four years. The gain that may be excluded does not

include the amount of deferred gain.

Note A list of qualified Wisconsin businesses that have

registered with the department for 2015 is available at:

revenue.wi.gov/report/q.html#qual.

Attachments

A copy of Schedule CG must be enclosed with your Wisconsin

• Attaches a completed Schedule CG to the individual’s

income tax return.

Wisconsin income tax return for the taxable year in which

the deferral of gain is claimed.

Additional Information

Specific Instructions

If you have questions about the deferral of gain, contact any

Wisconsin Department of Revenue office or write or call:

Line 3 This is the amount of long-term capital gain that may

be deferred if reinvested in a qualified Wisconsin business.

Customer Service Bureau,

Individuals claim the deferral of gain when completing

Wisconsin Department of Revenue

Wisconsin Schedule WD.

Mail Stop 5-77

PO Box 8949

Line 4 The date on line 4 must be within 180 days of the date

Madison WI 53708-8949

on line 1. If not within 180 days, you do not qualify for the

deferral of gain.

Telephone: 608) 266-2486

You may also email your questions to:

Line 5 Complete line 5 if the long-term gain was reinvested in

income@revenue.wi.gov

a qualified Wisconsin business. Fill in the name of the business

and the federal employer identification number (FEIN) of the

Return to Page 1

business.

1

1 2

2