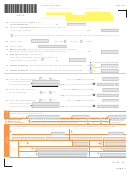

Form N-11 (Rev. 2015)

Page 2 of 4

Your Social Security Number

Your Spouse’s SSN

JBF152

Name(s) as shown on return

ROUND TO THE NEAREST DOLLAR

t

IF NEGATIVE, PLACE MINUS SIGN

-

7

Federal adjusted gross income (AGI) (see page 11 of the Instructions) .......................................

7

8

Difference in state/federal wages due to COLA, ERS,

etc. (see page 12 of the Instructions) .................................. 8

9

Interest on out-of-state bonds

(including municipal bonds) ................................................. 9

10

Other Hawaii additions to federal AGI

(see page 12 of the Instructions) ...................................... 10

11

Add lines 8 through 10 .................. Total Hawaii additions to federal AGI

11

t

IF NEGATIVE, PLACE MINUS SIGN

-

12

Add lines 7 and 11 ......................................................................................................................... 12

13

Pensions taxed federally but not taxed by Hawaii

(see page 14 of the Instructions) ....................................... 13

14

Social security benefits taxed on federal return................. 14

15

First $6,198 of military reserve or Hawaii national

guard duty pay ................................................................... 15

16

Payments to an individual housing account ...................... 16

17

Exceptional trees deduction (attach affidavit)

(see page 15 of the Instructions) ....................................... 17

18

Other Hawaii subtractions from federal AGI

(see page 15 of the Instructions) ....................................... 18

19

Add lines 13 through 18

............................................ Total Hawaii subtractions from federal AGI

19

t

IF NEGATIVE, PLACE MINUS SIGN

-

ä

20

Line 12 minus line 19 ............................................................................................ Hawaii AGI

20

CAUTION: If you can be claimed as a dependent on another person’s return, see the Instructions on page 16, and place an X here.

21

If you do not itemize your deductions, go to line 23 below. Otherwise go to page 17 of the Instructions

and enter your itemized deductions here.

21a

Medical and dental expenses

(from Worksheet A-1) ...................................................... 21a

TOTAL ITEMIZED

21b

Taxes (from Worksheet A-2) ............................................ 21b

DEDUCTIONS

22 Add lines 21a through 21f.

If your federal and/or Hawaii

21c

Interest expense (from Worksheet A-3) ........................... 21c

adjusted gross income is above

a certain amount, you may not

be able to deduct all of your

21d

Contributions (from Worksheet A-4) ................................ 21d

itemized deductions. See the

Instructions on page 21. Enter

total here and go to line 24.

21e

Casualty and theft losses (from Worksheet A-5) ............. 21e

21f

Miscellaneous deductions (from Worksheet A-6) ............. 21f

23

If you checked filing status box: 1 or 3 enter $2,200;

ä

2 or 5 enter $4,400; 4 enter $3,212 ........................................................Standard Deduction

23

t

IF NEGATIVE, PLACE MINUS SIGN

-

24 Line 20 minus line 22 or 23, whichever applies. (This line MUST be filled in) .................. 24

ID NO 99

FORM N-11

1

1 2

2 3

3 4

4 5

5 6

6