12. Has your organization registered with the Virginia Department Agriculture and Consumer Services (VDACS),

Office of Charitable and Regulatory Services to solicit contributions in Virginia? See pages 3-4 of the

instructions.

□

□

YES

NO

NOTE: Before TAX can approve your exemption application, you must contact VDACS to verify if your

organization has met the registration requirements. If VDACS determines that your organization is not required

to register, check NO. If your organization is required to register, check YES and provide proof of registration

from VDACS. Contact VDACS at (804) 786-1343.

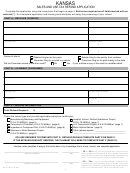

Section VII - Signature

I declare that this organization’s financial information is true, accurate, and complete.

___________________________________________________________ Date __________________

Authorized Representative

MAILING INFORMATION: Send completed form with attachments or change of address to:

Virginia Department of Taxation

Office of Customer Services

Nonprofit Exemption Unit

Post Office Box 27125

Richmond, Virginia 23261-7125

Telephone Number (804) 371-4023

Fax: 804-786-2645

CHECKLIST

Please make sure all questions are answered and that the following documents are included with

the application, if required:

501(c)(3) or 501(c)(4) - IRS Determination Letter

Mission Statement or Statement of Purpose

Proof of registration for Virginia Solicitation of Contributions Law

Federal Form 990, 990-EZ, 990-PF, 990-N, or substitute form

Independent Financial Audit or Review from an Independent Certified Public Accountant

Estimate of Total Taxable Purchases in Virginia (estimates are acceptable)

Authorized Representative’s Signature

NOTE: Incomplete applications will not be processed

Va. Dept. of Taxation

Rev. (08/15/2013)

Page 4

1

1 2

2 3

3 4

4