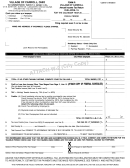

INSTRUCTIONS

WHO MUST FILE. Every nonprofit organization, volunteer fire company, or volunteer first-aid, rescue, ambulance,

or emergency squad licensed to conduct bingo must file this return. A return is required for every tax period, or

portion of a tax period, from each organization holding a license, even when no tax is due.

WHEN AND WHERE TO FILE. This return, properly signed, with a check payable to the Nebraska Department

of Revenue for the balance reported on line 4, is considered timely filed if postmarked on or before the 30th

day of the month following the end of the tax period covered by the return. Mail to the Nebraska Department of

Revenue, Charitable Gaming Division, P.O. Box 94855, Lincoln, Nebraska 68509-4855.

Organizations licensed to conduct bingo must file

Nebraska Schedule I – Bingo Activity Report

with

this return.

PREIDENTIFIED RETURN. This return must be used only by the licensed organization whose name is printed

on it. Do not file returns which are photocopies, are for another tax period, or have not been preidentified. If

you have not received a return for the tax period, and will be filing a paper return, request a duplicate from the

Charitable Gaming Division, or visit our website at to print a Form 51B. Complete

the ID number, tax period, name, and address information.

PENALTY AND INTEREST. If the return is not filed by the due date, a penalty will be assessed in the amount

of ten percent of the tax not paid by the due date, or $25, whichever is greater. Interest on any unpaid tax will be

assessed at the rate specified in

Neb. Rev. Stat. § 45-104.02

from the due date until payment is received. Failure to

file the return and remit the tax may result in license suspension, cancellation, or revocation for noncompliance.

VERIFICATION AND AUDIT. Records to substantiate this return must be kept available for three years following

the date of filing the return.

SPECIFIC INSTRUCTIONS

LINE 1. Enter the gross receipts from the bingo occasion. Gross receipts include admission charges, the sale

or rental of regular and special bingo cards and instant bingo cards, any fee charged for the use of bingo card

monitoring devices, and the value of in-kind payments from line 5, Column A, Nebraska Schedule I – Bingo

Activity Report.

LINE 2. Multiply line 1 by the state tax rate indicated. This is the amount of bingo tax due to the Nebraska Department

of Revenue (Department).

LINE 3. A balance due or credit resulting from a partial payment, mathematical or clerical error, penalty, or

interest relating to prior returns will be entered in this space by the Department. The amount of interest includes

interest on unpaid tax through the due date of this return. If the amount due is paid before the due date, interest

will be recomputed, and a credit will be given on your next return. If the amount entered has been satisfied by a

previous remittance, it should be disregarded when computing the amount to remit on line 4. If a credit is shown,

it may be applied to the current tax liability.

LINE 4. Attach a check made payable to the Nebraska Department of Revenue for the amount reported on line 4.

Checks may be presented electronically.

AUTHORIZED SIGNATURE. This return must be signed by an organization officer, utilization of funds member,

or other duly authorized individual. A person who is paid for preparing this return must also sign the return as a

preparer.

Any questions regarding the completion of the Nebraska Bingo Tax Return, Form 51B, should be addressed to

the Nebraska Department of Revenue, Charitable Gaming Division, P.O. Box 94855, Lincoln, NE 68509-4855,

telephone (402) 471-5937 or toll free (877) 564-1315.

1

1 2

2