Instructions For Form 4568 - Michigan Business Tax (Mbt) Nonrefundable Credits Summary

ADVERTISEMENT

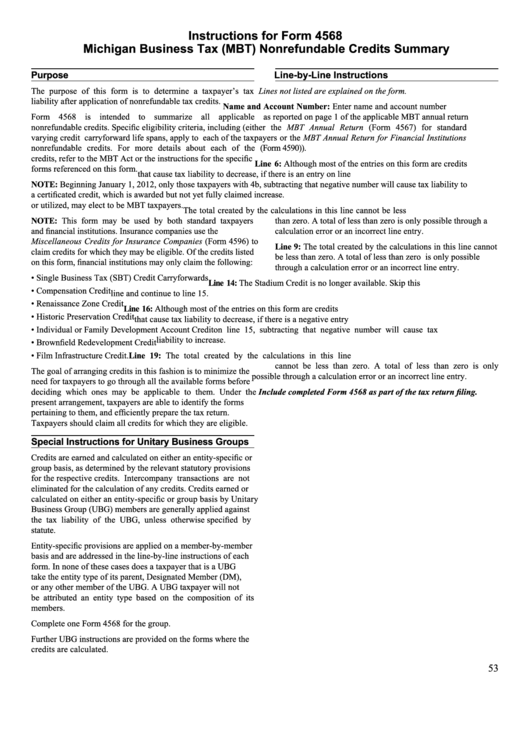

Instructions for Form 4568

Michigan Business Tax (MBT) Nonrefundable Credits Summary

Purpose

Line-by-Line Instructions

The purpose of this form is to determine a taxpayer’s tax

Lines not listed are explained on the form.

liability after application of nonrefundable tax credits.

Name and Account Number: Enter name and account number

Form 4568 is intended to summarize all applicable

as reported on page 1 of the applicable MBT annual return

nonrefundable credits. Specific eligibility criteria, including

(either the MBT Annual Return (Form 4567) for standard

varying credit carryforward life spans, apply to each of the

taxpayers or the MBT Annual Return for Financial Institutions

nonrefundable credits. For more details about each of the

(Form 4590)).

credits, refer to the MBT Act or the instructions for the specific

Line 6: Although most of the entries on this form are credits

forms referenced on this form.

that cause tax liability to decrease, if there is an entry on line

NOTE: Beginning January 1, 2012, only those taxpayers with

4b, subtracting that negative number will cause tax liability to

a certificated credit, which is awarded but not yet fully claimed

increase.

or utilized, may elect to be MBT taxpayers.

The total created by the calculations in this line cannot be less

NOTE: This form may be used by both standard taxpayers

than zero. A total of less than zero is only possible through a

and financial institutions. Insurance companies use the

calculation error or an incorrect line entry.

Miscellaneous Credits for Insurance Companies (Form 4596) to

Line 9: The total created by the calculations in this line cannot

claim credits for which they may be eligible. Of the credits listed

be less than zero. A total of less than zero is only possible

on this form, financial institutions may only claim the following:

through a calculation error or an incorrect line entry.

• Single Business Tax (SBT) Credit Carryforwards

Line 14: The Stadium Credit is no longer available. Skip this

• Compensation Credit

line and continue to line 15.

• Renaissance Zone Credit

Line 16: Although most of the entries on this form are credits

• Historic Preservation Credit

that cause tax liability to decrease, if there is a negative entry

• Individual or Family Development Account Credit

on line 15, subtracting that negative number will cause tax

liability to increase.

• Brownfield Redevelopment Credit

• Film Infrastructure Credit.

Line 19: The total created by the calculations in this line

cannot be less than zero. A total of less than zero is only

The goal of arranging credits in this fashion is to minimize the

possible through a calculation error or an incorrect line entry.

need for taxpayers to go through all the available forms before

Include completed Form 4568 as part of the tax return filing.

deciding which ones may be applicable to them. Under the

present arrangement, taxpayers are able to identify the forms

pertaining to them, and efficiently prepare the tax return.

Taxpayers should claim all credits for which they are eligible.

Special Instructions for Unitary Business Groups

Credits are earned and calculated on either an entity-specific or

group basis, as determined by the relevant statutory provisions

for the respective credits. Intercompany transactions are not

eliminated for the calculation of any credits. Credits earned or

calculated on either an entity-specific or group basis by Unitary

Business Group (UBG) members are generally applied against

the tax liability of the UBG, unless otherwise specified by

statute.

Entity-specific provisions are applied on a member-by-member

basis and are addressed in the line-by-line instructions of each

form. In none of these cases does a taxpayer that is a UBG

take the entity type of its parent, Designated Member (DM),

or any other member of the UBG. A UBG taxpayer will not

be attributed an entity type based on the composition of its

members.

Complete one Form 4568 for the group.

Further UBG instructions are provided on the forms where the

credits are calculated.

53

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1