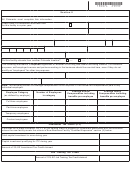

*130074==29999*

Section II

All Claimants must complete this information.

Check here if a certification has been filed

Tax Year Ending

(MM/YY)

for this facility in a prior year:

Enterprise Zone

Type of Business (retail, mfg, farm, etc)

Business Name

Address — Actual Location of Facility

Zip

City

State

NAICS code from

Colorado Account Number

SSN or FEIN

Date facility began operations at this location

Business Phone Number

(

)

Did this facility relocate from another Colorado location?

Yes

No

The following information is required regardless of whether or not any jobs credits are being claimed. For statistical

purposes, self-employed owners and partners working in the business should be counted here, even if they do not

qualify as "employees" for other tax purposes.

Number of owners/workers/employees at facility beginning of tax year

Number at end of tax year

Change in total (end of year – beginning)

Number of employees transferred from another Colorado facility owned by taxpayer to this facility

Note: The following section on average compensation is not required if it will reveal the compensation paid to any

individual employee.

Average Annual

Average Hourly

Employee Category

Number of Employees

Compensation including

Compensation including

(as defined by employer)

in category

benefits per employee

benefits per employee

Full-time employees

Part-time employees

Temporary employees

Contract employees

Investment Tax Credit (ITC)

If this was an in-state relocation, no ITC or job training credit is allowed on investment associated with the relocation

unless the new facility meets the criteria in New Business Facility "Qualified Expansion" section (2) below.

Total capital investment in zone during year

$

Capital investment qualifying for ITC during year

$

Amount of 3% EZ Investment Tax Credit claimed

$

Job Training Tax Credit

Number of employees trained

Amount of 10% EZ Job Training Tax Credit claimed

$

1

1 2

2 3

3