*130074==39999*

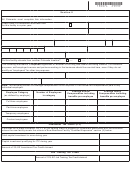

New Business Facility Jobs Credit

Number of qualifying new business facility jobs

Were the qualifying employees leased

Yes

No

from another company?

Amount of new business facility jobs tax credit claimed

$

Amount of agricultural processing new business facility jobs tax credit claimed

$

Amount of health insurance new business facility jobs tax credit claimed

$

Enhanced Rural EZ credits:

Qualified County

Enhanced new business facility jobs tax credit claimed

$

Enhanced agricultural processing NBF jobs tax credit claimed

$

To claim new jobs credits, you must qualify under one of the following three criteria

a. Give date facility was established

(MM/DD/YY)

1. If qualifying new business facility:

a. Give date of qualification

(MM/DD/YY)

2. If qualifying expansion new business facility

10 employee increase over preceding

$1,000,000 investment

12 month average

b. Was qualification a result of

10 percent employment increase over

100% investment increase

preceding 12 month average

3. If qualifying replacement new business facility

a. Give date of qualification

(MM/DD/YY)

b. Was qualification a result of

$3,000,000 investment

or

300% investment increase

Taxpayer Signature

I declare that all of the above information is true and correct to the best of my knowledge and belief.

Signature of Authorized Company Official/Owner

Print Name

Date

(MM/DD/YY)

Title

Business Name

Colorado Account Number, FEIN or SSN

Tax preparer or other contact for follow up information (please print)

Fax Number

Phone Number

(

)

(

)

E-mail address

Certification by Zone Administrator

I, the duly authorized administrator of the above-mentioned Enterprise Zone, hereby certify to the State of

Colorado, Department of Revenue that the above named facility is entirely within the designated Enterprise Zone.

Effective Date of Zone for the Location

(MM/DD/YY)

Signature of Zone Administrator

Date

(MM/DD/YY)

For more information about Enterprise Zone, contact the agencies listed below:

Colorado Department of Revenue

Colorado Office of Economic Development

and International Trade

Denver, CO 80261-0005

Phone: 303-238-SERV (7378)

1625 Broadway, Suite 2700

See "FYI" Publications for additional information:

Denver, CO 80202

Phone: 303-892-3840

1

1 2

2 3

3