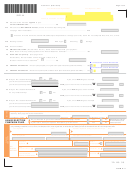

Form N-11 (Rev. 2014)

Page 4 of 4

Your Social Security Number

Your Spouse’s SSN

JBF144

,

Name(s) as shown on return

46

Amount of line 45 to be applied to your

2015 ESTIMATED TAX ..................................................... 46

47a

Amount to be REFUNDED TO YOU (line 45 minus line 46) If fi ling late,

see page 28 of Instructions ........................................................................................................... 47a

Place an X in this box if this refund will ultimately be deposited to a foreign (non-U.S.) bank. Do not complete lines 47b, 47c, or 47d.

47b

Routing number

47c Type:

Checking

Savings

47d

Account number

48

AMOUNT YOU OWE (line 36 minus line 41). Send Form N-200V with your payment.

Make check or money order payable to the “Hawaii State Tax Collector”. ..................................... 48

49

Estimated tax penalty. (See page 29 of

Instructions.) Do not include on line 42 or 48. Place an X in

this box if Form N-210 is attached

................... 49

t

IF NEGATIVE, PLACE MINUS SIGN

-

50

AMENDED RETURN ONLY – Amount paid (overpaid) on original return. (See Instructions) (attach Sch. AMD) ....... 50

t

IF NEGATIVE, PLACE MINUS SIGN

-

51

AMENDED RETURN ONLY – Balance due (refund) with amended return. (See Instructions) (attach Sch. AMD) ..... 51

52 Did you fi le a federal Schedule C?

Yes

No

If yes, enter Hawaii gross receipts

your main business activity:

,

W

your main business product:

,

AND your HI Tax I.D. No. for this activity

53 Did you fi le a federal Schedule E

If yes, enter Hawaii gross rents received

for any rental activity?

Yes

No

W

AND your HI Tax I.D. No. for this activity

54 Did you fi le a federal Schedule F?

Yes

No

If yes, enter Hawaii gross receipts

your main business activity:

,

W

your main business product:

,

AND your HI Tax I.D. No. for this activity

If designating another person to discuss this return with the Hawaii Department of Taxation, complete the following. This is not a full power of

attorney. See page 30 of the Instructions.

Designee’s name

Phone no.

Identifi cation number

Note: Placing an X in the “Yes”

HAWAII ELECTION

Do you want $3 to go to the Hawaii Election Campaign Fund?

Yes

No

box will not increase your tax

CAMPAIGN FUND

If joint return, does your spouse want $3 to go to the fund?

Yes

No

or reduce your refund.

DECLARATION — I declare, under the penalties set forth in section 231-36, HRS, that this return (including accompanying schedules or statements) has been examined by me and, to the best

of my knowledge and belief, is a true, correct, and complete return, made in good faith, for the taxable year stated, pursuant to the Hawaii Income Tax Law, Chapter 235, HRS.

Your signature

Date

Spouse’s signature (if fi ling jointly, BOTH must sign)

Date

Your Occupation

Daytime Phone Number

Your Spouse’s Occupation

Daytime Phone Number

Date

Preparer’s identifi cation number

Preparer’s

Check if

Signature

self-employed

Paid

Print

Preparer’s

Federal E.I. No.

Preparer’s Name

Information

Firm’s name (or yours

Phone No.

if self-employed),

Address, and ZIP Code

ID NO 99

FORM N-11

1

1 2

2 3

3 4

4 5

5 6

6