2

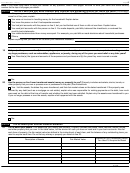

Form 8857 (Rev. 1-2014)

Page

Note. If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security

number on the top of all pages you attach.

Part II

Tell us about yourself and your spouse for the tax years you want relief (Continued)

6

What is the current marital status between you and the person on line 5?

Married and still living together

Married and living apart since

MM

DD

YYYY

Widowed since

Attach a photocopy of the death certificate and will (if one exists).

MM

DD

YYYY

Legally separated since

Attach a photocopy of your entire separation agreement.

MM

DD

YYYY

Divorced since

Attach a photocopy of your entire divorce decree.

MM

DD

YYYY

Note. A divorce decree stating that your former spouse must pay all taxes does not necessarily mean you qualify for relief.

7

What was the highest level of education you had completed when the return(s) were filed? If the answers are not the same for all

tax years, explain.

Did not complete high school

High school diploma or equivalent

Some college

College degree or higher. List any degrees you have

▶

List any college-level business or tax-related courses you completed

▶

Explain

▶

8

Were you or other members of your family a victim of spousal abuse or domestic violence, or suffering the effects of such

abuse during any of the tax years you want relief or when any of the returns were filed for those years?

Yes. If you want the IRS to consider this information in making its determination, complete Part V of this form in addition to other

parts of the form. First read the instructions for Part V, to understand how the IRS will proceed with evaluating your claim for relief

in these circumstances.

If you checked “Yes” above, we will put a note on your separate account. This will enable us to respond appropriately and be

sensitive to your situation. We will remove the note from your account if you request it (as explained in the instructions).

If you do not want us to put a note on your account, check here .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

No. Complete the other parts of this form except for Part V.

9

When any of the returns listed on line 3 were filed, did you have a mental or physical health problem or do you have a mental

or physical health problem now? If the answers are not the same for all tax years, explain below.

Yes. Attach a statement to explain the problem and when it started. Provide photocopies of any documentation, such as

medical bills or a doctor’s report or letter.

No.

Explain

▶

10

Is there any information you are afraid to provide on this form, but are willing to discuss?

Yes

No

Part III

Tell us if and how you were involved with finances and preparing returns for those tax years

11

Did you agree to file a joint return?

Yes

No

Explain why or why not

▶

12

Did you sign the joint return? See instructions.

Yes

No

Explain why or why not

▶

8857

Form

(Rev. 1-2014)

1

1 2

2 3

3 4

4 5

5 6

6 7

7