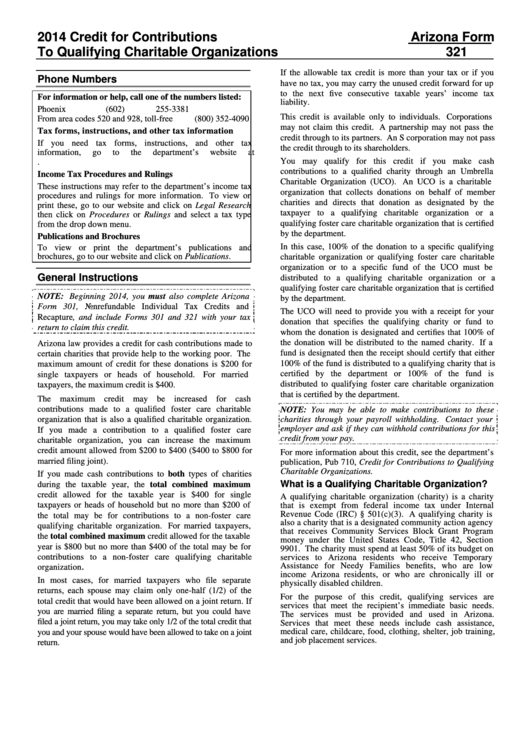

Instructions For Form 321 - Credit For Contributions To Qualifying Charitable Organizations - 2014

ADVERTISEMENT

2014 Credit for Contributions

Arizona Form

To Qualifying Charitable Organizations

321

If the allowable tax credit is more than your tax or if you

Phone Numbers

have no tax, you may carry the unused credit forward for up

to the next five consecutive taxable years’ income tax

For information or help, call one of the numbers listed:

liability.

Phoenix

(602) 255-3381

This credit is available only to individuals. Corporations

From area codes 520 and 928, toll-free

(800) 352-4090

may not claim this credit. A partnership may not pass the

Tax forms, instructions, and other tax information

credit through to its partners. An S corporation may not pass

If you need tax forms, instructions, and other tax

the credit through to its shareholders.

information,

go

to

the

department’s

website

at

You may qualify for this credit if you make cash

contributions to a qualified charity through an Umbrella

Income Tax Procedures and Rulings

Charitable Organization (UCO). An UCO is a charitable

These instructions may refer to the department’s income tax

organization that collects donations on behalf of member

procedures and rulings for more information. To view or

charities and directs that donation as designated by the

print these, go to our website and click on Legal Research

taxpayer to a qualifying charitable organization or a

then click on Procedures or Rulings and select a tax type

qualifying foster care charitable organization that is certified

from the drop down menu.

by the department.

Publications and Brochures

In this case, 100% of the donation to a specific qualifying

To view or print the department’s publications and

brochures, go to our website and click on Publications.

charitable organization or qualifying foster care charitable

organization or to a specific fund of the UCO must be

General Instructions

distributed to a qualifying charitable organization or a

qualifying foster care charitable organization that is certified

NOTE: Beginning 2014, you must also complete Arizona

by the department.

Form 301, Nonrefundable Individual Tax Credits and

The UCO will need to provide you with a receipt for your

Recapture, and include Forms 301 and 321 with your tax

donation that specifies the qualifying charity or fund to

return to claim this credit.

whom the donation is designated and certifies that 100% of

the donation will be distributed to the named charity. If a

Arizona law provides a credit for cash contributions made to

fund is designated then the receipt should certify that either

certain charities that provide help to the working poor. The

100% of the fund is distributed to a qualifying charity that is

maximum amount of credit for these donations is $200 for

certified by the department or 100% of the fund is

single taxpayers or heads of household.

For married

distributed to qualifying foster care charitable organization

taxpayers, the maximum credit is $400.

that is certified by the department.

The maximum credit may be increased for cash

contributions made to a qualified foster care charitable

NOTE: You may be able to make contributions to these

organization that is also a qualified charitable organization.

charities through your payroll withholding. Contact your

employer and ask if they can withhold contributions for this

If you made a contribution to a qualified foster care

credit from your pay.

charitable organization, you can increase the maximum

credit amount allowed from $200 to $400 ($400 to $800 for

For more information about this credit, see the department’s

married filing joint).

publication, Pub 710, Credit for Contributions to Qualifying

Charitable Organizations.

If you made cash contributions to both types of charities

What is a Qualifying Charitable Organization?

during the taxable year, the total combined maximum

credit allowed for the taxable year is $400 for single

A qualifying charitable organization (charity) is a charity

taxpayers or heads of household but no more than $200 of

that is exempt from federal income tax under Internal

Revenue Code (IRC) § 501(c)(3). A qualifying charity is

the total may be for contributions to a non-foster care

also a charity that is a designated community action agency

qualifying charitable organization. For married taxpayers,

that receives Community Services Block Grant Program

the total combined maximum credit allowed for the taxable

money under the United States Code, Title 42, Section

year is $800 but no more than $400 of the total may be for

9901. The charity must spend at least 50% of its budget on

contributions to a non-foster care qualifying charitable

services to Arizona residents who receive Temporary

.

Assistance for Needy Families benefits, who are low

organization

income Arizona residents, or who are chronically ill or

In most cases, for married taxpayers who file separate

physically disabled children.

returns, each spouse may claim only one-half (1/2) of the

For the purpose of this credit, qualifying services are

total credit that would have been allowed on a joint return. If

services that meet the recipient’s immediate basic needs.

you are married filing a separate return, but you could have

The services must be provided and used in Arizona.

filed a joint return, you may take only 1/2 of the total credit that

Services that meet these needs include cash assistance,

medical care, childcare, food, clothing, shelter, job training,

you and your spouse would have been allowed to take on a joint

and job placement services.

return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3