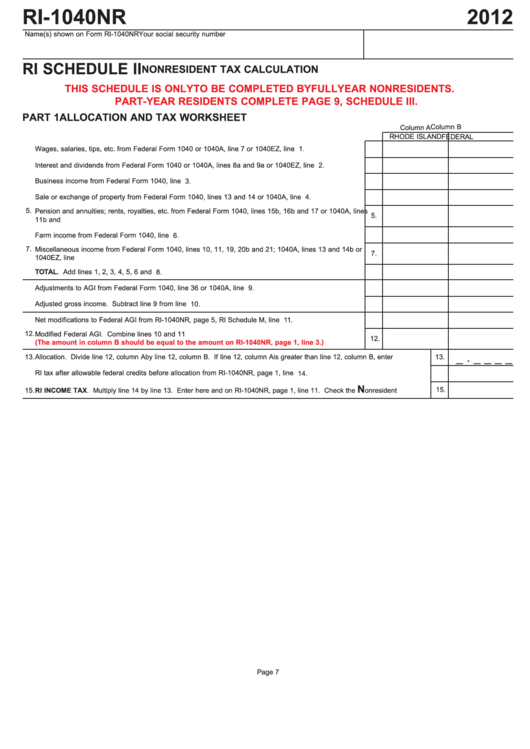

Form Ri-1040nr - Ri Schedule Ii - Nonresident Tax Calculation - 2012

ADVERTISEMENT

RI-1040NR

2012

Name(s) shown on Form RI-1040NR

Your social security number

RI SCHEDULE II

NONRESIDENT TAX CALCULATION

THIS SCHEDULE IS ONLY TO BE COMPLETED BY FULL YEAR NONRESIDENTS.

PART-YEAR RESIDENTS COMPLETE PAGE 9, SCHEDULE III.

PART 1

ALLOCATION AND TAX WORKSHEET

Column B

Column A

RHODE ISLAND

FEDERAL

1.

Wages, salaries, tips, etc. from Federal Form 1040 or 1040A, line 7 or 1040EZ, line 1..................................

1.

2.

Interest and dividends from Federal Form 1040 or 1040A, lines 8a and 9a or 1040EZ, line 2........................

2.

3.

Business income from Federal Form 1040, line 12...........................................................................................

3.

4.

Sale or exchange of property from Federal Form 1040, lines 13 and 14 or 1040A, line 10.............................

4.

5.

Pension and annuities; rents, royalties, etc. from Federal Form 1040, lines 15b, 16b and 17 or 1040A, lines

5.

11b and 12b.......................................................................................................................................................

6.

Farm income from Federal Form 1040, line 18.................................................................................................

6.

7.

Miscellaneous income from Federal Form 1040, lines 10, 11, 19, 20b and 21; 1040A, lines 13 and 14b or

7.

1040EZ, line 3....................................................................................................................................................

8.

TOTAL. Add lines 1, 2, 3, 4, 5, 6 and 7............................................................................................................

8.

9.

Adjustments to AGI from Federal Form 1040, line 36 or 1040A, line 20...........................................................

9.

10.

Adjusted gross income. Subtract line 9 from line 8..........................................................................................

10.

11.

Net modifications to Federal AGI from RI-1040NR, page 5, RI Schedule M, line 3..........................................

11.

12.

Modified Federal AGI. Combine lines 10 and 11

12.

(The amount in column B should be equal to the amount on RI-1040NR, page 1, line

3.)......................

_ . _ _ _ _

13.

Allocation. Divide line 12, column A by line 12, column B. If line 12, column A is greater than line 12, column B, enter 1.0000.......

13.

14.

RI tax after allowable federal credits before allocation from RI-1040NR, page 1, line 10...................................................................

14.

N

15.

RI INCOME TAX. Multiply line 14 by line 13. Enter here and on RI-1040NR, page 1, line 11. Check the

onresident box............

15.

Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2