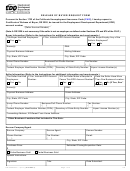

Form 3500a - California Submission Of Exemption Request Page 3

ADVERTISEMENT

2014 Instructions for Form FTB 3500A

Submission of Exemption Request

Exemption Based on Internal Revenue Code (IRC) Sections 501(c)(3), 501(c)(4), 501(c)(5), 501(c)(6), or 501(c)(7), Federal Determination Letter

References in these instructions are to the IRC as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

The organization must notify the FTB when the Internal Revenue Service

(IRS) revokes their federal tax-exempt status. The FTB will revoke the

All corporations and unincorporated organizations, even if organized

organization’s tax-exempt status if the organization fails to meet certain

on a nonprofit basis, are subject to California corporation franchise or

Revenue and Taxation Code (R&TC) provisions governing exempt

income tax until the Franchise Tax Board (FTB) gives exempt status to

organizations. If an organization’s tax-exempt status is revoked or denied,

the organization. Until the exemption is given, the organization remains

the organization will need to file form FTB 3500 to reinstate its

taxable.

tax-exempt status.

California acknowledges federally tax exempt Internal Revenue Code

D Incorporating in California

(IRC) Sections 501(c)(3), 501(c)(4), 501(c)(5), 501(c)(6), or 501(c)(7),

organizations as tax-exempt from state income tax if the organization

If the organization is not incorporated in California and wishes to do so,

submits form FTB 3500A, Submission of Exemption Request, and a copy

the organization should first incorporate with the California Secretary of

of its federal determination letter to the FTB.

State (SOS), then file form FTB 3500A with the FTB to obtain tax-exempt

status. For more information on incorporating, go to the SOS’s website

Disclosure of Application Materials

sos.ca.gov.

Until the FTB acknowledges an organization’s tax-exempt status, the

application and all associated documentation is confidential. The FTB

An unincorporated organization that has tax-exempt status, and then

may not discuss the application with any unauthorized person. However,

incorporates, must reapply for California tax-exempt status.

once the organization’s exemption is acknowledged, the application, and

Foreign Corporations

supporting documents, shall be open to public inspection.

If the organization is incorporated in another state or country, it is

Upon the organization’s request, public disclosure of documents relating

considered a “foreign corporation.” The organization may qualify to do

to any trade secrets, patents, process, style of work, or apparatus may be

business in California if it complies with the California Corporations

withheld if the FTB determines that disclosure would adversely affect the

Code requirements. For more information on qualifying, go to the SOS’s

organization. Additionally, public disclosure of documents may also be

website sos.ca.gov.

withheld if the disclosure would adversely affect national defense.

Organizational Requirements

Get California Form 3500, Exemption Application Booklet, this booklet

A Purpose

contains Guidelines for Organizing Documents, sample articles, and

Use form FTB 3500A, to obtain California tax-exempt status, if the

organizational requirements.

organization has a federal determination letter granting exemption under

E Trusts

IRC Sections 501(c)(3), 501(c)(4), 501(c)(5), 501(c)(6), or 501(c)(7).

An organization without a federal determination letter may not use form

Trusts organized and operated for purposes described in R&TC

FTB 3500A. Organizations without a federal determination letter must use

Section 23701d are treated as nonprofit corporations for tax-exempt

form FTB 3500, Exemption Application. For more information, go to

purposes.

ftb.ca.gov and search for 3500.

F Retroactive Exempt Status

B What and Where to File

For California franchise and income tax purposes, organizations seeking

Send form FTB 3500A, with an original signature of either:

exemption based on their federal determination letter will be tax-exempt

• An elected officer

for state purposes beginning on the federal exempt effective date on the

• A director

federal determination letter. If the entity’s incorporation date is prior to

• An authorized representative

the federal effective determination date, consider filing form FTB 3500.

• A trustee (if the organization is a trust)

We may consider this form as a claim for refund if the organization is

Mail completed form FTB 3500A, with a copy of the organization’s IRC

subsequently found to be tax-exempt during the same period it previously

Sections 501(c)(3), 501(c)(4), 501(c)(5), 501(c)(6), or 501(c)(7), federal

paid tax. Under Cal. Regs., tit.18, section 23701, in no event shall a claim

determination letter to:

for refund be allowed unless timely filed under R&TC Section 19306.

EXEMPT ORGANIZATIONS UNIT MS F120

G Group Exemption

FRANCHISE TAX BOARD

PO BOX 1286

Parent organizations requesting group exemption for their subordinates

RANCHO CORDOVA CA 95741-1286

complete PART II of this form.

If additional information is required, we will contact the officer or

If the parent organization does not want to obtain group exemption, but

representative designated on form FTB 3500A.

wants tax-exempt status for specific subordinates, have each subordinate

send the following:

If you have questions about form FTB 3500A, call 916.845.4171.

• Form FTB 3500A, with the subordinate’s name on the form.

C What Happens Next

• A copy of the parent organization’s group ruling letter from the IRS, or

a letter from the IRS to the subordinate that indicates the subordinate

Upon receipt of the completed documents, the FTB will send the

is covered under the parent organization’s IRS group exemption.

organization a letter acknowledging the federal tax exemption under IRC

• A letter from the parent organization on their letterhead indicating the

Sections 501(c)(3), 501(c)(4), 501(c)(5), 501(c)(6), or 501(c)(7), and

entity is a subordinate of their organization.

specify the effective date of the organization’s exemption under California

law.

FTB 3500A Instructions 2014 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5