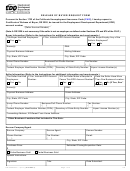

Form 3500a - California Submission Of Exemption Request Page 4

ADVERTISEMENT

H Suspended/Forfeited Status

PART I — Entity Information

Line 1 – Entity type

An organization must be active and in good standing to retain tax-exempt

Check the box for the exempt organization’s entity type.

status. If the organization is not currently in good standing and all filing

requirements have been satisfied and/or amounts due have been paid,

Corporation: The entity has endorsed articles of incorporation from the

this form may be considered a request to bring the organization relief

California SOS, or is a foreign entity that has articles of incorporation on

from suspension or forfeiture under R&TC Section 23776.

file in another state or country.

Association: The entity is not incorporated in California, another state, or

I

IRS Revocation

country.

If the organization’s IRS exemption is revoked and then reinstated. Send

Trust: A trust may be created by language in a will or in a written trust

us a copy of the following with the Form 3500A:

instrument. The trust creates legal obligations for the person (trustee)

• Original IRS exemption determination letter

who manages the assets of the trust.

• IRS revocation letter

Foreign Corporation: Incorporated in another state or country. Give the

• Current IRS exemption determination letter

name of the state or foreign country in which the entity is incorporated.

J Filing Requirements

Line 5 – IRS information

If the entity was suspended, revoked, or audited by the IRS, check the

California tax-exempt organizations may have to file one or more of the

“Yes” box and explain the reason for the suspension, revocation, or audit

following returns:

by the IRS.

• Form 199, California Exempt Organization Annual Information Return.

PART II — Group Exemption

• FTB 199N, Annual Electronic Filing Requirement for Small Exempt

Organizations, (California e-Postcard).

The parent organization must have California tax-exempt status before it

• Form 109, California Exempt Organization Business Income Tax

can apply for group exemption.

Return.

List of subordinates

For more information about state filing requirements, fees, and penalties,

Include a list of subordinates to be covered under the group exemption.

get FTB Pub. 1068, Exempt Organizations – Filing Requirements and

The list must include:

Filing Fees or go to ftb.ca.gov and search for 1068.

• Name of subordinate

• California corporation number

Specific Line Instructions

• Federal employer identification number

Provide the following:

• Address

• Date subordinate affiliated with parent.

• California Corporation number (seven digits) or California SOS file

number (12 digits)

PART III — Purpose and Activity

• Federal Employer identification number (FEIN)

Mark the appropriate purpose and activity box under your specific

• Organization name as shown in the organization’s creating document

exemption section based on your federal determination letter.

• Address

Private Mail Box (PMB) – Include PMB number in the address field.

Write “PMB” first, then the box number. Example: PMB 123.

Page 2 FTB 3500A Instructions 2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5