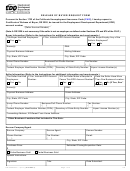

Form 3500a - California Submission Of Exemption Request Page 5

ADVERTISEMENT

How to Get California Tax Information

(Keep this page for future use.)

Automated Phone Service

Your Rights As A Taxpayer

Use our automated phone service to get recorded answers to many of

Our goal includes making certain that your rights are protected so

your questions about California taxes and to order California Business

that you have the highest confidence in the integrity, efficiency, and

Entity tax forms and publications. This service is available in English and

fairness of our state tax system. FTB 4058, California Taxpayers’ Bill of

Spanish to callers with touch-tone telephones. Have paper and pencil

Rights, includes information on your rights as a California taxpayer, the

ready to take notes.

Taxpayers’ Rights Advocate Program, and how you request written advice

from the FTB on whether a particular transaction is taxable.

Call from within the United States

800.338.0505

Call from outside the United States

916.845.6500

Where to Get Tax Forms and Publications

Where to Get General Tax Information

By Internet – You can download, view, and print California tax forms and

publications at ftb.ca.gov.

By Internet – You can get answers to Frequently Asked Questions

at ftb.ca.gov.

By Phone – You can order California tax forms from 6 a.m. to 10 p.m.

weekdays, 6 a.m. to 4:30 p.m. Saturdays, except holidays. Call our

By Phone – You can hear recorded answers to Frequently Asked

automated phone service at the number listed above. Select “ Business

Questions 24 hours a day, 7 days a week. Call our automated phone

Entity Information,” then select “Forms and Publications.” Follow the

service at the number listed above. Select “Business Entity Information,”

recorded instructions and enter the 3-digit code, listed below, when

then select “Frequently Asked Questions.” Enter the 3-digit code, listed

prompted. To order prior year forms, call the number listed under

below, when prompted.

“Assistance.”

Code – Prefiling Assistance

Allow two weeks to receive your order. If your corporation’s mailing

715 – If my actual tax is less than the minimum franchise tax, what figure

address is outside California, allow three weeks.

do I put on line 23 of Form 100 or Form 100W?

717 – What are the current tax rates for corporations?

Code

718 – How do I get an extension of time to file?

817 – California Corporation Tax Forms and Instructions. This booklet

722 – When does my corporation file a short period return?

includes: Form 100, California Corporation Franchise or Income Tax

734 – Is my corporation subject to a franchise tax or income tax?

Return

814 – Form 109, California Exempt Organization Business Income Tax

S Corporations

Return

704 – Is an S corporation subject to the minimum franchise tax?

815 – Form 199, California Exempt Organization Annual Information

705 – Are S corporations required to file estimated payments?

Return

706 – What forms do S corporations file?

818 – Form 100-ES, Corporation Estimated Tax

707 – The tax for my S corporation is less than the minimum franchise

802 – FTB 3500, Exemption Application

tax. What figure do I put on line 21 of Form 100S?

831 – FTB 3500A, Submission of Exemption Request

Exempt Organizations

943 – FTB 4058, California Taxpayers’ Bill of Rights

709 – How do I get tax-exempt status?

By Mail – Write to:

710 – Does an exempt organization have to file Form 199?

735 – Does an exempt organization have to file FTB 199N, California

TAX FORMS REQUEST UNIT

e-Postcard?

FRANCHISE TAX BOARD

736 – I have exempt status. Do I need to file Form 100 or Form 109 in

PO BOX 307

addition to Form 199?

RANCHO CORDOVA CA 95741-0307

Minimum Tax and Estimate Tax

General Phone Service

712 – What is the minimum franchise tax?

Telephone assistance is available year-round from 7 a.m. until 5 p.m.

714 – My corporation is not doing business; does it have to pay the

Monday through Friday, except holidays. Hours are subject to change.

minimum franchise tax?

Telephone:

800.852.5711 from within the United States

Billings and Miscellaneous Notices

916.845.6500 from outside the United States

723 – I received a bill for $250. What is this for?

TTY/TDD:

800.822.6268 for persons with hearing or speech

Miscellaneous

impairments

701 – I need a state Employer ID number for my business. Who do I

IRS:

800.829.4933 call the IRS for federal tax questions

contact?

Asistencia en español

703 – How do I incorporate?

Asistencia telefónica está disponible durante todo el año desde las 7 a.m.

737 – Where do I send my payment?

hasta las 5 p.m. de lunes a viernes, excepto días feriados. Las horas

están sujetas a cambios.

Letters

Teléfono:

800.852.5711 dentro de los Estados Unidos

If you write to us, be sure your letter includes the California corporation

916.845.6500 fuera de los Estados Unidos

number, or FEIN, your daytime and evening telephone numbers, and a

TTY/TDD:

800.822.6268 para personas con discapacidades auditivas

copy of the notice. Send your letter to:

o del habla

EXEMPT ORGANIZATIONS UNIT MS F-120

IRS:

800.829.4933 para preguntas sobre impuestos federales

FRANCHISE TAX BOARD

PO BOX 1286

RANCHO CORDOVA CA 95741-1286

We will respond to your letter within ten weeks. In some cases we may

need to call you for additional information. Do not attach correspondence

to your tax return unless it relates to an item on the return.

FTB 3500A Instructions 2014 Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5