Instructions For Form 165 - Arizona Partnership Income Tax Return - 2014 Page 13

ADVERTISEMENT

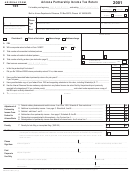

Arizona Form 165

Lines 1 through 5 - Capital Gain (Loss) Reported on

Line 7 - Long-Term Capital Loss Carryover

Federal Schedule D

If the partnership used a long-term capital loss carryover from

a previous tax year to reduce its long-term capital gain for the

Enter the long-term capital gain (loss) from each federal form

current taxable year, enter the amount used to apply to gains

listed that was reported on the partnerhsip’s federal Schedule D

from assets acquired before January 1, 2012, in column (b).

and included on Schedule K of federal Form 1065.

Line 8 - Net Long-Term Capital Gain (Loss)

Line 6 - Subtotal

Subtract line 7 from line 6 and enter the difference in each

For each column, add the amounts on lines 1 through 5 and

column.

enter the total.

For each partner, enter the distributive share of the amounts

in each column on line 8 of the worksheet on Part II of

Arizona Form 165, Schedule K-1 or on Part III of Arizona

Form 165, Schedule K-1(NR).

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13