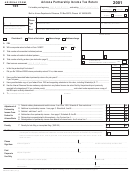

Instructions For Form 165 - Arizona Partnership Income Tax Return - 2014 Page 4

ADVERTISEMENT

Arizona Form 165

D. Credit for Solar Hot Water Heater Plumbing Stub

health savings account for which a tax credit is claimed under

Outs or Electric Vehicle Recharge Outlets

A.R.S. §§ 43-1087.01 or 43-1185.

Enter the amount of expenses deducted in computing Arizona

Line A4 - Other Additions to Partnership Income

taxable income for the installation of solar hot water heater

Enter the following "other additions" to the partnership

plumbing stub outs or electric vehicle recharge outlets for

income reported on line 1. Include a schedule listing each

which the taxpayer claimed the credit under A.R.S.

item separately.

§§ 43-1090 or 43-1176.

A. Excess of a Partner's Share of Partnership Taxable

E. Credit for Employment of Temporary Assistance for

Income or Loss

Needy Families (TANF) Recipients

Make this adjustment if the partnership is a partner of another

Enter the amount of wage expenses deducted pursuant to the

partnership. Enter the excess of a partner's share of

Internal Revenue Code for which the taxpayer claimed the

partnership taxable income or loss included under A.R.S.

TANF credit under A.R.S. §§ 43-1087 or 43-1175.

§§ 43-1401 through 43-1413 over the income reported under

IRC § 702(a)(8).

F. Agricultural Pollution Control Equipment Credit

B. Income Recognized Because of Difference in Adjusted

Excess Federal Depreciation or Amortization

Basis of Property

Enter the excess of depreciation or amortization

Enter the amount by which the adjusted basis of property

computed on the federal basis of the property over

depreciation or amortization computed on the Arizona

described in A.R.S. § 43-1021(6), computed according to the

adjusted basis of the property. Make this adjustment for

Internal Revenue Code, exceeds the adjusted basis according

the property for which the partnership elected to claim a

to Arizona law. Basis computed according to Arizona law

tax credit under A.R.S. §§ 43-1081.01 or 43-1170.01.

means according to Title 43 of the Arizona Revised Statutes

effective January 1, 1979, and the Income Tax Act of 1954,

Excess in Federal Adjusted Basis

as amended. This adjustment applies to all property, held for

Enter the amount by which the federal adjusted basis of

the production of income, sold, or otherwise disposed of

the property exceeds the Arizona adjusted basis of the

during the taxable year. This adjustment does not apply to

property. Make this adjustment if the property for which

depreciable property used in a trade or business.

the partnership elected to claim a tax credit under A.R.S.

§§ 43-1081.01 or 43-1170.01 was sold or otherwise

C. Federal Depreciation of Child Care Facilities

disposed of during the taxable year.

Arizona's statutes, which allow special amortization for the

cost of day care facilities, are no longer applicable to

G. Credit for Donation of School Site

partnerships. However, if the partnership elected to claim the

Enter the amount deducted pursuant to the Internal Revenue

special amortization under Arizona's former statutory

Code representing a donation of a school site for which the

provisions, the partnership must continue to amortize these

taxpayer claimed the credit for donation of school site under

items in accordance with those provisions. Therefore, the

A.R.S. §§ 43-1089.02 or 43-1181.

partnership must make the same additions to and subtractions

H. Motion Picture Credits

from Arizona gross income that Arizona's former statutory

provisions required. If this applies to the partnership, enter

This credit is in lieu of any allowance for deduction of expenses

the amount of depreciation deducted for these items on the

related to the production or related to a transferred credit. Enter

federal partnership return.

the amount of any such expenses that were deducted in

computing federal taxable income for which the credit was

Line 2 - Total Additions to Partnership Income

claimed or transferred under former A.R.S. §§ 43-1075 or

Add lines A1 through A4. Enter the total.

43-1163.

Line 3 - Subtotal

I.

Credit for Corporate Contributions to School Tuition

Organizations

Add lines 1 and 2. Enter the total.

Enter the amount deducted in computing federal taxable

Schedule B - Subtractions From Partnership

income as contributions for which a credit is claimed under

Income

A.R.S. § 43-1183.

Line B1 - Recalculated Arizona Depreciation For

J. Credit for Corporate Contributions to School Tuition

Current Year

Organizations for Displaced Students or Students

With Disabilities

NEW Arizona Bonus Depreciation: If you had assets

Enter the amount deducted in computing federal taxable

placed in service in taxable years beginning from and after

income as contributions for which a tax credit is claimed

December 31, 2012 and you claimed the bonus depreciation

under A.R.S. § 43-1184.

on your federal tax returns, see the department’s individual

income tax procedure, ITP 14-3, before completing line B1.

K. Credit for Qualified Health Insurance Plans

For assets placed in service in taxable years beginning before

Enter the amount deducted in computing federal taxable

December 31, 2012, enter the total amount of depreciation

income for health insurance premiums or contributions to a

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13