Instructions For Form 165 - Arizona Partnership Income Tax Return - 2014 Page 2

ADVERTISEMENT

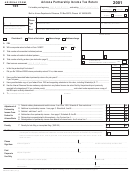

Arizona Form 165

Do not file an amended return until the original return has

Process Administration Section at (602) 716-7095 for the

been processed. Mail the amended return to:

most updated filing options.

Arizona Department of Revenue

Rounding Dollar Amounts

PO Box 52153

Taxpayers must round amounts to the nearest whole dollar. If

Phoenix, AZ 85072-2153

50 cents or more, round up to the next dollar. If less than 50

Records

cents, round down.

The partnership should maintain books and records

Penalties

substantiating information reported on the return and keep

This form is an information return. The penalty for failing to file,

these documents for inspection. Arizona General Tax Ruling

filing late (including extensions) or filing an incomplete

GTR 96-1 discusses the general requirements for the

information return is $100 for each month, or fraction of a month,

maintenance and retention of books, records and other sources

that the failure continues, up to a maximum penalty of $500.

of information received, created, maintained or generated

through various computer, electronic and imaging processes

IRC § 7519 - Required Payments

and systems. Refer to this tax ruling for further information.

Taxpayers cannot deduct the federal required payments on

Partnerships should complete three copies of Form 165,

their Arizona tax returns as an ordinary and necessary

Schedule K-1 or Schedule K-1(NR) for each partner. File one

business expense or otherwise.

copy of each partner's Schedule K-1 or Schedule K-1(NR)

with the partnership's Form 165. Provide all partners with a

Specific Instructions

copy of their Schedule K-1 or Schedule K-1(NR). Retain a

copy of each Schedule K-1 or Schedule K-1(NR) for the

Type or print the required information in the name, address,

partnership's records.

and information boxes on the top of page 1.

If the

partnership has a foreign address, enter the information in the

NOTE: Use Form 165, Schedule K-1, for all resident and

following order: city, province or state, and country. Follow

part-year resident individual partners, all resident estate

the country’s practice for entering the postal code. Do not

partners, and all resident trust partners. Use Form 165,

abbreviate the country’s name.

Indicate whether the

Schedule K-1(NR), for all other partners.

taxable year is a calendar year or a fiscal year; if a fiscal year,

OPTIONAL REPORTING FORMAT for Schedule K-1

indicate the taxable year on the top of the return. Indicate

and Schedule K-1(NR) required to be included with

whether this return is an original or an amended return.

Arizona Form 165: The department will accept a hard copy

Enter the partnership's employer identification number (EIN),

spreadsheet that contains all the requested information or the

which is the taxpayer identification number (TIN).

information may be submitted on electronic media as a

Microsoft Excel spreadsheet on a CD-ROM or DVD. The

All returns, statements, and other documents filed with the

chosen media must be Microsoft Windows compatible.

department require a TIN. The TIN for a corporation,

S corporation, or a partnership is the taxpayer's EIN. The TIN

Taxpayers submitting the information on CD-ROM or DVD

for an individual is the taxpayer's social security number or

should secure the CD-ROM or DVD in a hard case and

an IRS individual taxpayer identification number. The TIN

include it with the tax return. The Schedule K-1 and

for a paid tax return preparer is that individual's social

Schedule K-1(NR) submitted on CD-ROM or DVD are part

security number or the employer identification number of the

of the income tax return and are subject to the sworn

business. Taxpayers and paid tax preparers who fail to

statement on the return that they are correct to the best of the

include their TIN may be subject to a penalty.

signer’s knowledge and belief.

If the taxpayer has a valid federal or Arizona extension, file

The CD-ROM or DVD should be labeled with the

the return by the extended due date. If the taxpayer files

partnership's name, employer identification number, taxable

under extension, the taxpayer must check box 82E on page 1

year and Form 165, Schedule K-1/K-1(NR). Partnerships

may password protect the CD-ROM or DVD and email the

of the return.

password separately to MediaLibrarian@azdor.gov. Include

Other Information (Page 1)

“Form 165, Schedule K-1/K-1(NR)” in the subject line of the

Answer all questions (A through N).

email. In the body of the email, include the same information

Line E: Enter the total number of entity partners

that is on the CD-ROM or DVD label. If the CD-ROM or

(corporations, estates, exempt organizations, partnerships, S

DVD is password protected, include the email address the

corporations, and/or trusts).

password originated from on the label of the CD-ROM or

DVD. The department will not return or copy any media.

NOTE: The total of the amounts entered for questions C, D,

and E should equal the total number of partners.

CAUTION: The partnership substitutes the CD-ROM or

DVD at its own risk and understands that the information

Line H: For taxable years beginning from and after

may need to be provided to the department again at a later

December 31, 2013, a multistate service provider may elect

date if it is not accessible by the department for any reason.

to treat sales from services as being in Arizona based on a

The department is currently evaluating other methods of

combination of income producing activity sales and market

accepting the required schedules. Please contact the

sales prescribed under A.R.S. § 43-1147(B). Taxpayers who

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13