Instructions For Form 165 - Arizona Partnership Income Tax Return - 2014 Page 3

ADVERTISEMENT

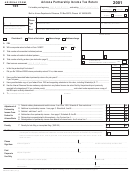

Arizona Form 165

want to make the election should check the applicable boxes

Line A2 - Non-Arizona Municipal Bond Interest

on line H and include the completed Schedule MSP with the

Enter interest income received from any state or municipal

tax return. See the specific instructions for the apportionment

obligations (other than Arizona) credited to or earned by the

formula on these instructions. Also refer to A.R.S. § 43-1147

partnership during the taxable year. Reduce the amount of

and Schedule MSP instructions for more information.

interest income by the amount of any interest on indebtedness

and other related expenses incurred or continued to purchase

Line M: Report any adjustments made by the IRS to any

or carry those obligations that were not otherwise deducted or

federal income tax return filed by the partnership not

subtracted in the computation of Arizona gross income. Do

previously reported to the department. Mail these adjustments

not include interest from obligations specifically exempt from

separately to:

Arizona income tax, nor any related expenses.

Arizona Department of Revenue

Line A3 - Additions Related to Arizona Tax Credits

PO Box 52153

Phoenix, AZ 85072-2153.

Enter on line A3 the following additions to partnership

income that are related to Arizona tax credits. Include a

Adjustment of Partnership Income from

schedule detailing these additions.

Federal to Arizona Basis

A. Environmental Technology Facility Credit

Note: The 2004 Internal Revenue Code conformity bill

These adjustments apply to partnerships that elected to claim

(SB 1389) made changes affecting tax years beginning from

a tax credit under A.R.S. §§ 43-1080 or 43-1169 and have

and after December 31, 1999. Arizona conforms but makes

sold or otherwise disposed of the facility or any component of

specific additions and subtractions that have the effect of not

the facility during the taxable year.

conforming to the increased IRC § 179 expense limitation

and the 30% and 50% bonus depreciation provisions of IRC

Excess Federal Depreciation or Amortization

§ 168(k). Because depreciation is reported at the partnership

Enter the excess of depreciation or amortization

level, adjustments will need to be made in the partnership

computed on the federal basis of the facility over

additions and subtractions. Because IRC § 179 expenses are

depreciation or amortization computed on the Arizona

reported at the partner level, Form 165 requires no

adjusted basis of the facility.

adjustments relating to those expenses. Partners must make

the adjustments on their income tax returns (for example, on

Excess in Federal Adjusted Basis

Form 140 or Form 120).

Enter the amount by which the federal adjusted basis of the

facility exceeds the Arizona adjusted basis of the facility.

UPDATE to 2004 Conformity: In HB 2531 (2013), the

statutory addition for IRC § 179 expenses conforms to federal

B. Pollution Control Credit

for tax years beginning from and after January 1, 2013. The

Excess Federal Depreciation or Amortization

subtraction will continue to be allowed for taxable years prior

Enter the excess of depreciation or amortization

to 2013.

computed on the federal basis of the property over

Note: The 2009 Internal Revenue Code conformity bill

depreciation or amortization computed on the Arizona

(HB 2156) made changes affecting tax years beginning from

adjusted basis of the property. Make this adjustment for

and after December 31, 2008. Arizona conforms but makes

the property for which the partnership elected to claim a

specific additions and subtractions that have the effect of not

tax credit under A.R.S. §§ 43-1081 or 43-1170.

conforming to the deferral of discharge of indebtedness

(DOI) income under IRC § 108(i) and the deferral of original

Excess in Federal Adjusted Basis

issue discount (OID) deduction under IRC § 108(i). Because

Enter the amount by which the federal adjusted basis of

the partnership can determine the amount of deferred DOI

the property exceeds the Arizona adjusted basis of the

and OID to allocate to each partner in any manner, not

property. Make this adjustment if the property for which

necessarily based on ownership or profit percentage,

the partnership elected to claim a tax credit under A.R.S.

Form 165 requires no adjustments relating to these deferrals.

§§ 43-1081 or 43-1170 was sold or otherwise disposed of

Partners must make the adjustments on their income tax

during the taxable year.

returns (for example, on Form 140 or Form 120).

C. Credit for Taxes Paid for Coal Consumed in

Line 1 - Federal Ordinary Business and Rental Income

Generating Electrical Power in Arizona

Enter the total of ordinary income (loss) from trade or business

Enter the amount of expenses deducted pursuant to the Internal

activities, rental real estate activities, and other rental activities

Revenue Code for which the taxpayer claimed the credit for

from the federal Form 1065, Schedule K. Include a copy of the

taxes paid for coal consumed in generating electrical power in

federal Form 1065 and its component schedules.

Arizona. The addition is required for the amount of Arizona

Schedule A - Additions to Partnership Income

transaction privilege taxes and Arizona use taxes included in the

computation of federal taxable income for which the Arizona

Line A1 - Total Federal Depreciation

credit is claimed under A.R.S. § 43-1178.

Enter the total amount of depreciation deducted on the federal

return.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13