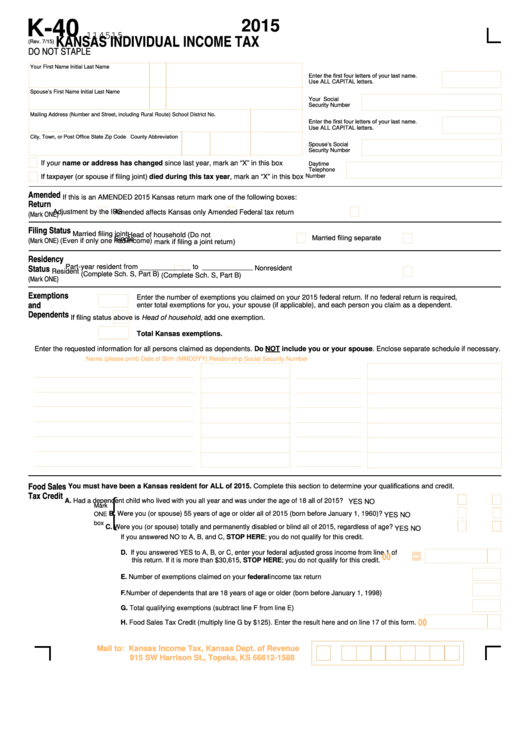

2015

K-40

KANSAS INDIVIDUAL INCOME TAX

114515

(Rev. 7/15)

DO NOT STAPLE

Your First Name

Initial

Last Name

Enter the first four letters of your last name.

Use ALL CAPITAL letters.

Spouse’s First Name

Initial

Last Name

Your Social

Security Number

Mailing Address (Number and Street, including Rural Route)

School District No.

Enter the first four letters of your last name.

Use ALL CAPITAL letters.

City, Town, or Post Office

State

Zip Code

County Abbreviation

Spouse’s Social

Security Number

If your name or address has changed since last year, mark an “X” in this box

Daytime

Telephone

If taxpayer (or spouse if filing joint) died during this tax year, mark an “X” in this box

Number

Amended

If this is an AMENDED 2015 Kansas return mark one of the following boxes:

Return

(Mark ONE)

Amended affects Kansas only

Amended Federal tax return

Adjustment by the IRS

Filing Status

Married filing joint

Head of household (Do not

Married filing separate

(Mark ONE)

Single

mark if filing a joint return)

(Even if only one had income)

Residency

Status

Part-year resident from _____________ to _____________

Nonresident

Resident

(Complete Sch. S, Part B)

(Complete Sch. S, Part B)

(Mark ONE)

Exemptions

Enter the number of exemptions you claimed on your 2015 federal return. If no federal return is required,

and

enter total exemptions for you, your spouse (if applicable), and each person you claim as a dependent.

Dependents

If filing status above is Head of household, add one exemption.

Total Kansas exemptions.

Enter the requested information for all persons claimed as dependents. Do NOT include you or your spouse. Enclose separate schedule if necessary.

Name (please print)

Date of Birth (MMDDYY)

Relationship

Social Security Number

Food Sales

You must have been a Kansas resident for ALL of 2015. Complete this section to determine your qualifications and credit.

Tax Credit

{

A. Had a dependent child who lived with you all year and was under the age of 18 all of 2015? .............. YES

NO

Mark

B. Were you (or spouse) 55 years of age or older all of 2015 (born before January 1, 1960)? .................. YES

ONE

NO

box

C. Were you (or spouse) totally and permanently disabled or blind all of 2015, regardless of age? .......... YES

NO

If you answered NO to A, B, and C, STOP HERE; you do not qualify for this credit.

00

D. If you answered YES to A, B, or C, enter your federal adjusted gross income from line 1 of

this return. If it is more than $30,615, STOP HERE; you do not qualify for this credit.

E. Number of exemptions claimed on your federal income tax return ........................................................

F. Number of dependents that are 18 years of age or older (born before January 1, 1998) ......................

G. Total qualifying exemptions (subtract line F from line E) ........................................................................

00

H. Food Sales Tax Credit (multiply line G by $125). Enter the result here and on line 17 of this form.

Mail to: Kansas Income Tax, Kansas Dept. of Revenue

915 SW Harrison St., Topeka, KS 66612-1588

1

1 2

2