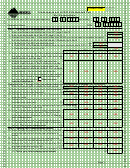

FORM N-220

(REV. 2014)

PAGE 2

Part III

Figuring the Penalty

(a)

(b)

(c)

(d)

16 Enter the amount of underpayment(s) from Part II, line 14

16

in the respective columns (a) through (d) ..........................

17 Enter the estimated tax installment due dates used in Part

17

II, line 6 in the respective columns (a) through (d) ............

18 Enter the date each estimated tax installment was paid or

the 20th day of the fourth month following the close of the

18

tax year, whichever is earlier for columns (a) through (d) ..

19 Enter the number of months from the date shown on line

17 to the date on line 18 for columns (a) through (d) (See

19

instructions) .......................................................................

20 Multiply the following: Number of months on line 19 x .00667

20

x underpayment on line 16 for columns (a) through (d) ...........

21 Underpayment penalty — Add line 20, columns (a) through (d). Enter the total here and on Form N-30, line 17; Form

21

N-35, line 24; or Form N-70NP, line 22 .............................................................................................................................

Schedule A

Required Installments Using the Annualized Income Installment Method and/or the Adjusted

Seasonal Installment Method Under IRC Section 6655(e)

Form N-35 filers: For lines 2, 12, 13, and 14 below, “taxable income” refers to excess net passive income or the amount on which tax is imposed under

IRC section 1374(a) (or the corresponding provisions of prior law), whichever applies.

Part I — Annualized Income Installment Method

(a)

(b)

(c)

(d)

First _______

First _______

First _______

First _______

1 Annualization period (see Instructions).

1

months

months

months

months

2 Enter taxable income for each annualization period.

2

3 Annualization amount (see Instructions).

3

4 Annualized taxable income. Multiply line 2 by line 3.

4

5 Figure the tax on the net capital gains and ordinary

income in each column on line 4 by following the instruc-

tions for Form N-30, Schedule J, lines 13 thru 16; Form

5

N-35, lines 22a and 22b; or Form N-70NP, Part I or Part II.

6 Enter other taxes for each payment period (see

6

Instructions).

7 Total tax. Add lines 5 and 6.

7

8 For each period, enter the same type of credits as al-

8

lowed for Form N-220, line 2 (see Instructions).

9 Total tax after credits. Line 7 minus line 8. If zero or less,

9

enter -0-.

10 Applicable percentage.

10

25%

50%

75%

100%

11 Multiply line 9 by line 10.

11

Form N-220

1

1 2

2 3

3 4

4