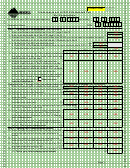

FORM N-220

(REV. 2014)

PAGE 3

Schedule A

Part II — Adjusted Seasonal Installment Method (Caution: Use this method only if the base period percentage for

any 6 consecutive months is at least 70%. See the Instructions for more information.)

(a)

(b)

(c)

(d)

First 3

First 5

First 8

First 11

months

months

months

months

12 Enter the taxable income for the following periods:

a Tax year beginning in 2011

12a

b Tax year beginning in 2012

12b

c Tax year beginning in 2013

12c

13 Enter taxable income for each period for the tax year

13

beginning in 2014.

(a)

(b)

(c)

(d)

First 4

First 6

First 9

Entire year

months

months

months

14 Enter the taxable income for the following periods:

a Tax year beginning in 2011

14a

b Tax year beginning in 2012

14b

c Tax year beginning in 2013

14c

15 Divide the amount in each column on line 12a by the

15

amount in column (d) on line 14a.

16 Divide the amount in each column on line 12b by the

16

amount in column (d) on line 14b.

17 Divide the amount in each column on line 12c by the

17

amount in column (d) on line 14c.

18 Add lines 15 through 17.

18

19 Divide line 18 by 3.

19

20 Divide line 13 by line 19.

20

21 Figure the tax on line 20 following the instructions for

Form N-30, Schedule J, lines 13 thru 16; Form N-35,

21

lines 22a and 22b; or Form N-70NP, Part I or Part II.

22 Divide the amount in columns (a) through (c) on line 14a

22

by the amount in column (d) on line 14a.

23 Divide the amount in columns (a) through (c) on line 14b

23

by the amount in column (d) on line 14b.

24 Divide the amount in columns (a) through (c) on line 14c

24

by the amount in column (d) on line 14c.

25 Add lines 22 through 24.

25

26 Divide line 25 by 3.

26

27 Multiply the amount in columns (a) through (c) of line 21

by the amount in the corresponding column of line 26. In

27

column (d), enter the amount from line 21, column (d).

(Continued on page 4)

Form N-220

1

1 2

2 3

3 4

4