Instructions to Transferee/Buyer

check the box for an individual or revocable living trust. For all other trusts and estates,

check the box for a trust or estate.

(NOTE: References to “married”, “unmarried”, and “spouse” also means “in a

Box 7 — Check the box, if applicable. The transferor/seller must provide written

civil union”, “not in a civil union”, and “civil union partner”, respectively.)

notification to the transferee/buyer prior to the transfer date if the transferor/seller

Prepare Form N-288A for each nonresident transferor/seller subject to withholding. If

will elect out of the installment method and report the gain in full in the year of sale.

two or more nonresident transferors/sellers jointly transfer a Hawaii real property

If a transferee/buyer does not receive written notification, the transferee/buyer shall

interest, prepare a separate Form N-288A for each nonresident transferor/seller.

assume that the transferor/seller will report the gain under the installment method.

One Form N-288A should be filed for a taxpayer and spouse if they will be filing a joint

Box 8 — Enter the Hawaii income tax withheld by you for the transferor/seller whose name

return for the year in which they transferred their Hawaii real property interest. Attach

appears on this form. If there are two or more nonresident transferors/sellers, indicate the

Copy A of Form(s) N-288A and your check or money order to Form N-288.

respective amounts withheld for each nonresident transferor/seller on a separate Form

Joint Transferors/Sellers

N-288A. If the amount required to be withheld has been waived or exempted, enter a zero

(0). If the amount required to be withheld has been reduced or waived by the Department of

If one or more nonresident persons and one or more resident persons jointly transfer

Taxation, attach a copy of the approved Form N-288B. Also, if one or more of the transferor/

a Hawaii real property interest, first, determine the amount subject to withholding by

sellers are exempt from the withholding and you are issuing the exempt transferor/seller a

allocating the amount realized from the transfer among the transferors/sellers based

Form N-288A, attach a copy of the exempt transferor/seller’s Form N-289.

on their capital contribution to the property. For this purpose, a taxpayer and spouse

Box 9 — Enter the identification number, (social security number or federal employer

are treated as having contributed 50% each. Second, withhold on the total amount

allocated to nonresident transferors/sellers. Third, credit the amount withheld among

identification number) of the transferor/seller. If the transferor/seller is a single member

the nonresident transferors/sellers as they mutually agree. The transferors/sellers must

LLC that has not elected to be taxed as a corporation, and the only member is an

request that the withholding be credited as agreed upon by the 10th day after the date

individual, enter the social security number of the individual. If the transferor/seller is a

of transfer. If no agreement is reached, credit the withholding by evenly dividing it

revocable living trust, or any other trust in which an individual is treated as the owner

among the nonresident transferors/sellers.

of the trust, enter the social security number of the individual. For all other trusts and

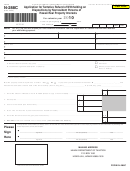

Box 1 — Enter a description of the property including its location and the nature of

estates, enter the federal employer identification number of the trust or estate.

Box 10 — If the transferors/sellers are taxpayer and spouse filing a joint return, enter

any substantial improvements, such as an apartment building or warehouse. Include

the tax map key.

the spouse’s social security number.

Box 2 — Enter the date of transfer. For payments on an installment sale, enter the

Box 11 — Enter the name and address of the transferor/seller. If the transferor/seller

payment date of the installment.

is a single member LLC that has not elected to be taxed as a corporation, and the only

Box 3 — Enter the amount realized by the transferor/seller whose name appears on

member is an individual, enter the name and address of the individual. If the transferor/

seller is a revocable living trust, or any other trust in which an individual is treated

this form. If the transferor/seller is reporting the gain under the installment method,

as the owner of the trust, enter the name and address of the individual. For all other

enter the principal portion of the total payments for the year.

trusts and estates, enter the name and address of the trust or estate. Do not enter

Box 4 — Enter the identification number (social security number or federal employer

information relating to the fiduciary.

identification number) of the transferee/buyer.

Box 12 — If the transferors/sellers are taxpayer and spouse filing a joint return, enter

Box 5 — Enter the name and address of the transferee/buyer.

the spouse’s name.

Box 6 — Check the applicable box to indicate whether the transferor/seller is an

Note: If the transferor/seller is a partnership, an S corporation, or a trust or estate,

individual or revocable living trust, a partnership, a corporation, an S corporation, or

please attach a schedule showing the name, identification number, and amount of

trust (including an irrevocable trust) or estate. If the transferor/seller is an LLC that files

the withholding allocated to each partner or member, S corporation shareholder, or

a partnership return, check the box for a partnership. If the transferor/seller is a single

beneficiary of the trust or estate. For trusts and final-year estates, this schedule does

member LLC that has not elected to be taxed as a corporation, and the only member

not replace the election that needs to be made on Form N-40T.

is an individual, check the box for an individual. If the transferor/seller is a revocable

.

For definitions and rules, see the Instructions for Form N-288

living trust, or any other trust in which an individual is treated as the owner of the trust,

Instructions to Transferee/Buyer

check the box for an individual or revocable living trust. For all other trusts and estates,

check the box for a trust or estate.

(NOTE: References to “married”, “unmarried”, and “spouse” also means “in a

Box 7 — Check the box, if applicable. The transferor/seller must provide written

civil union”, “not in a civil union”, and “civil union partner”, respectively.)

notification to the transferee/buyer prior to the transfer date if the transferor/seller

Prepare Form N-288A for each nonresident transferor/seller subject to withholding. If

will elect out of the installment method and report the gain in full in the year of sale.

two or more nonresident transferors/sellers jointly transfer a Hawaii real property

If a transferee/buyer does not receive written notification, the transferee/buyer shall

interest, prepare a separate Form N-288A for each nonresident transferor/seller.

assume that the transferor/seller will report the gain under the installment method.

One Form N-288A should be filed for a taxpayer and spouse if they will be filing a joint

Box 8 — Enter the Hawaii income tax withheld by you for the transferor/seller whose name

return for the year in which they transferred their Hawaii real property interest. Attach

appears on this form. If there are two or more nonresident transferors/sellers, indicate the

Copy A of Form(s) N-288A and your check or money order to Form N-288.

respective amounts withheld for each nonresident transferor/seller on a separate Form

Joint Transferors/Sellers

N-288A. If the amount required to be withheld has been waived or exempted, enter a zero

(0). If the amount required to be withheld has been reduced or waived by the Department of

If one or more nonresident persons and one or more resident persons jointly transfer

Taxation, attach a copy of the approved Form N-288B. Also, if one or more of the transferor/

a Hawaii real property interest, first, determine the amount subject to withholding by

sellers are exempt from the withholding and you are issuing the exempt transferor/seller a

allocating the amount realized from the transfer among the transferors/sellers based

Form N-288A, attach a copy of the exempt transferor/seller’s Form N-289.

on their capital contribution to the property. For this purpose, a taxpayer and spouse

Box 9 — Enter the identification number, (social security number or federal employer

are treated as having contributed 50% each. Second, withhold on the total amount

allocated to nonresident transferors/sellers. Third, credit the amount withheld among

identification number) of the transferor/seller. If the transferor/seller is a single member

the nonresident transferors/sellers as they mutually agree. The transferors/sellers must

LLC that has not elected to be taxed as a corporation, and the only member is an

request that the withholding be credited as agreed upon by the 10th day after the date

individual, enter the social security number of the individual. If the transferor/seller is a

of transfer. If no agreement is reached, credit the withholding by evenly dividing it

revocable living trust, or any other trust in which an individual is treated as the owner

among the nonresident transferors/sellers.

of the trust, enter the social security number of the individual. For all other trusts and

Box 1 — Enter a description of the property including its location and the nature of

estates, enter the federal employer identification number of the trust or estate.

Box 10 — If the transferors/sellers are taxpayer and spouse filing a joint return, enter

any substantial improvements, such as an apartment building or warehouse. Include

the tax map key.

the spouse’s social security number.

Box 2 — Enter the date of transfer. For payments on an installment sale, enter the

Box 11 — Enter the name and address of the transferor/seller. If the transferor/seller

payment date of the installment.

is a single member LLC that has not elected to be taxed as a corporation, and the only

Box 3 — Enter the amount realized by the transferor/seller whose name appears on

member is an individual, enter the name and address of the individual. If the transferor/

seller is a revocable living trust, or any other trust in which an individual is treated

this form. If the transferor/seller is reporting the gain under the installment method,

as the owner of the trust, enter the name and address of the individual. For all other

enter the principal portion of the total payments for the year.

trusts and estates, enter the name and address of the trust or estate. Do not enter

Box 4 — Enter the identification number (social security number or federal employer

information relating to the fiduciary.

identification number) of the transferee/buyer.

Box 12 — If the transferors/sellers are taxpayer and spouse filing a joint return, enter

Box 5 — Enter the name and address of the transferee/buyer.

the spouse’s name.

Box 6 — Check the applicable box to indicate whether the transferor/seller is an

Note: If the transferor/seller is a partnership, an S corporation, or a trust or estate,

individual or revocable living trust, a partnership, a corporation, an S corporation, or

please attach a schedule showing the name, identification number, and amount of

trust (including an irrevocable trust) or estate. If the transferor/seller is an LLC that files

the withholding allocated to each partner or member, S corporation shareholder, or

a partnership return, check the box for a partnership. If the transferor/seller is a single

beneficiary of the trust or estate. For trusts and final-year estates, this schedule does

member LLC that has not elected to be taxed as a corporation, and the only member

not replace the election that needs to be made on Form N-40T.

is an individual, check the box for an individual. If the transferor/seller is a revocable

.

For definitions and rules, see the Instructions for Form N-288

living trust, or any other trust in which an individual is treated as the owner of the trust,

1

1 2

2 3

3 4

4 5

5